- Key points to know before starting a credit card processing company

- Why start a credit card processing company?

- How to start a payment processing company: Step-by-step

- What are the options for starting a payment processing business?

- Optimizing Payment Processes for Efficiency and ROI

- How much does it cost to start a payment processing company?

- How to Start a Credit Card Processing Company FAQs

In today’s fast-evolving digital economy, credit card processing has become a cornerstone of frictionless commerce, fueling billions of transactions daily worldwide. So, how to start your own credit card processing company? If you’re researching how to start a credit card payment business, this guide will help you understand the business model, the required partnerships, and the compliance steps to launch responsibly.

Starting a credit card processing company is not only lucrative but increasingly indispensable with shifting consumer behavior towards cashless payments.

In this article, you’ll find all the necessary information on credit card processing for businesses, from how to start a credit card company to the cost of it. You’ll also learn how to open a credit card processing company step-by-step — from setup to compliance.

Here, you will find everything you need to know about business credit card processing — from launching your own credit card company to the price tag. Our founders hold more than 50 years of collective experience in the online payment space, and they will share worthwhile information and good counsel throughout this article to navigate the complexities of this cutthroat market.

Key points to know before starting a credit card processing company

Before you start credit card processing for businesses, you need to know the basics of this industry, the key players, and the roles they perform.

What is a credit card processing business?

A credit card processing business facilitates transactions between merchants and their customers by processing digital credit or debit cards. Simply put, credit card processors provide merchants with a technical layer to accept card payments on their websites.

Their essential functions include:

- Verifying whether a card is valid and has enough credit for the transaction.

- Facilitating the transfer of funds from the customer’s bank to the merchant’s account after processing the transaction successfully.

- Implementing fraud prevention measures to protect sensitive cardholder data.

- Providing software and infrastructure for merchants to process card transactions through their websites or applications securely.

- Offering hardware and software solutions for card processing.

What is a payment processing company?

A payment processing company can provide credit card processing within its operations. However, it is not limited to card transactions. Payment processing companies handle all forms of digital transactions to enable businesses to accept payments from their customers, including credit and debit cards, electronic funds transfers (EFTs), e-wallets, Buy Now Pay Later (BNPL), cryptocurrencies, etc.

If you’re considering entering the fintech market, understanding the role of these companies is essential for anyone exploring how to create a payment processing company that can compete on a global scale.

What is a payment service provider?

With such a variety of key players in the digital payments field, here’s where it gets tricky.

Payment Service Provider (PSP) offers payment services for facilitating digital payments between businesses and customers. PSPs provide their clients with various services, including payment processing itself and advanced technologies for improving transaction approval rates and minimizing declines.

What is a payment facilitator?

Another major player in the digital payments arena is a Payment Facilitator, also called PayFac. PayFac is a type of financial service provider that simplifies the process of accepting electronic payments for smaller businesses. Previously, the main task of PayFacs was to enable companies to quickly set up and start accepting payments without the need for a traditional merchant account that involves more complex underwriting and approval processes. However, PayFacs have evolved over time to meet the diverse needs of merchants, now providing a comprehensive range of services to enhance the overall payment experience. Learn more about PayFacs in our comprehensive guide.

What is a merchant processing company?

A merchant processing company specializes in providing payment processing services to merchants. It is often called MSP. MSPs and PSPs are related terms in the payment processing industry, but they refer to different types of entities with distinct roles and focuses. MSPs work directly with merchants to set up and manage merchant accounts, acting as middlemen between businesses and acquiring banks.

How does a payment processor work?

Being responsible for managing transaction processing, the payment processor holds a pivotal role within the electronic payment ecosystem. Here’s how a payment processor works.

When a customer makes a purchase, they enter their payment information. Then, the merchant’s payment system receives it and sends an authorization request to the payment processor. In turn, the payment processor processes the authorization request, verifying the customer’s sensitive information. Once verified, transaction details are sent by the processor to the issuing bank to check the customer’s account for sufficient funds and fraud alerts. If the issuing bank approves the transaction, it sends approval back to the payment processor. Lastly, the payment processor sends it to the merchant’s system. After that, the transaction is finally authorized.

Knowing these inner mechanics is crucial for those planning to get into the credit card processing business, as it forms the foundation of technical and financial operations.

Why start a credit card processing company?

Now that you know the fundamentals of the key players in the digital payments arena, let’s delve into reasons to start a credit card processing business.

As per the 2022 McKinsey Global Payments Report, electronic transactions saw a remarkable 19 percent growth rate in 2021, which indicates that the need for reliable payment processing solutions also continues to rise, making the time just about right to learn how to start a credit card company.

The second major factor is revenue consistency. Merchants rely on payment processors to accept payments from clients. Consequently, credit card processing business benefits from the recurring nature of their revenue streams, driven by transaction fees, monthly charges, and value-added services.

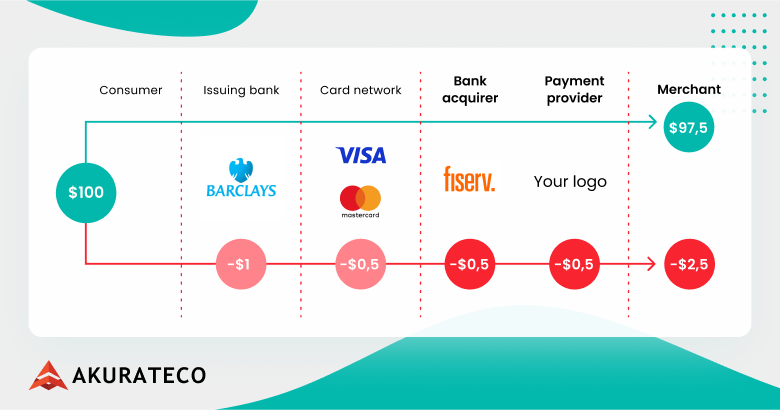

Here’s how credit card processors earn their revenue on transaction fees:

Profit potential is another good reason to start a credit card processing company. Payment processing companies can charge their clients not only for transaction processing but also for value-added offerings, such as white-label payment solutions, new integrations with new banks and payment providers, assistance with Payment Card Industry Data Security Standards (PCI DSS) certification, etc.

Lastly, credit card processors can quickly expand globally. Credit card processing for businesses allows a company to participate in cross-border transactions and attract business overseas.

If you are wondering how to become a credit card processor by now, let’s take a look at the options you have.

How to start a payment processing company: Step-by-step

Starting a payment processing company is a complex procedure. Here is a step-by-step guide to help you get started:

Step 1: Market

Conduct a comprehensive analysis of the market. Focus on the latest trends, features, and technologies. Based on the analysis, identify your business requirements, set clear goals, assess potential risks, and outline the core functions your software will need. With this information, design the payment gateway model and define how the system will function for end users.

Step 2: Business plan

Create a comprehensive business plan. Outline your company’s objectives, target market, revenue model, and strategies for achieving your goals. Understanding a payment gateway business model is essential at this stage, as it will help you determine how your credit card processing company will generate revenue. Here’s a glimpse of our detailed article covering the business model of payment gateways and how to proceed.

The payment gateway business model is centered on transaction-based revenue, which is complemented by various recurring and service fees provided by a payment orchestration company. By providing essential payment infrastructure and additional value-added services, gateway providers create scalable revenue streams. Key components of a payment gateway business model…

Step 3: Key features

After establishing your business plan, the next step is to define the key features your credit card processing system will need. Consider the system’s core functionalities, such as security, fraud detection, multi-currency support, and seamless integration with various e-commerce platforms. Additionally, consider the user’s perspective — both for merchants and buyers.

Step 4: Technology and infrastructure

Select the right technology stack and build the necessary infrastructure for your credit card processing company. In practice, this means choosing or building a secure credit card processing platform that can handle authorization flows, risk checks, routing logic, reporting, and scalability requirements. This includes choosing secure and scalable software solutions, determining the appropriate hardware requirements, and setting up data centers or cloud services.

Choosing cloud-based and API-driven systems is especially important if your goal is to start online payment processing company operations with minimal upfront infrastructure.

Step 5: Legal and regulatory compliance

The next crucial step is to choose a legal structure for your business and research payment processing regulatory requirements in your jurisdiction. To adhere to laws and regulations, ensure compliance with industry standards like PCI DSS, and obtain all the necessary licenses and permits.

These legal considerations apply whether you want to operate as a PSP or become a credit card merchant processor serving specific business verticals.

Step 6: Partnerships and relationships

Foster partnerships with banks, acquire merchant accounts, and collaborate with technology partners to develop a robust payment processing ecosystem for your merchants. Establishing these relationships can be challenging, especially for a newly launched brand.

Step 7: Marketing and launch

When your system is tested and ready to launch, promote it to your potential clients. You should develop a marketing strategy, build a strong sales team, and launch your payment processing business.

What are the options for starting a payment processing business?

When it comes to how to start a payment processing company, there are two main options. You can either develop a payment system on your own or leverage ready-to-use white-label software. Let’s examine each in detail.

Building payment software

Creating your payment system offers an unmatched level of flexibility, enabling you to customize it precisely to align with your business’s unique requirements. This approach allows you to gain complete control of your system, craft software that perfectly caters to your merchants’ needs, and ensure scalability for future growth. Yet, constructing your own software relies on three essential pillars: time, money, and expertise.

Developing your own payment system will require lots of resources. Furthermore, the work continues when the system is ready, as ongoing maintenance and improvement demand a significant dedication of resources.

For a thorough insight into the costs associated with developing your own software, dive into our in-depth article.

White label solution

There is a viable alternative to developing your own payment system for starting a credit card processing business – a white-label solution. It is a pre-configured customizable payment software that can be branded in your company’s name. It offers significant cost efficiency and a quick setup process, allowing entrepreneurs to start their business operations within a couple of weeks and begin capitalizing on it in no time.

White-label payment solutions can incorporate multiple technologies and integrations, which vary based on the provider. For instance, we at Akurateco offer white-label payment software equipped with cutting-edge technologies and over 300 integrated banks and payment providers via one integration to the platform. Among the supported technologies much needed to operate a payment processing business are:

- Intelligent routing

- Payment cascading

- Payment fraud prevention

- Tokenization

- Built-in payment analytics

- Optimized checkout

.. and more.

For many entrepreneurs starting credit card processing company operations, a white-label system dramatically reduces time to market and initial capital risk.

To learn more about a white-label payment gateway, check our in-depth guide.

Optimizing Payment Processes for Efficiency and ROI

After launching your credit card processing business, shifting focus toward operational efficiency and long-term profitability is essential. Optimizing payment processes helps reduce costs, improve transaction speed, and enhance the user experience — all of which contribute directly to ROI.

Key strategies include:

- Implementing Intelligent Payment Routing to automatically choose the most cost-effective and reliable acquiring bank based on geography, currency, or risk profile.

- Utilizing automated reconciliation and reporting solutions for reducing manual errors, saving time, and ensuring financial accuracy.

- Using AI-based fraud detection and chargeback management to protect revenue and prevent losses.

- Interpreting payment data to understand customer behavior, optimize conversion rate, and make informed business decisions.

- Ensuring scalability and multi-currency capability for surviving growth and expanding into new geographies without disrupting operations.

- High Revenue Potential: Payment processors stand to gain substantial revenue through transaction fees, setup fees, and value-added services, which together form the foundation of the payment processing business model.

Staying on top of it and streamlining your payment stack will give your business a competitive edge and drive long-term success. Consider ready-made white label payment processing solutions to quickly launch your business by customizing them to fit your brand.

How much does it cost to start a payment processing company?

Costs can vary greatly when it comes to starting a payment processing company. It depends on several factors, including the scale of your operation, the services you plan to offer, regulatory requirements in your region, technology infrastructure, and others. However, the main cost factor is whether you develop your own software or leverage a white-label system.

In-house payment software

If you decide to develop a payment system on your own, the costs associated with it will include developers’ salaries, technology and infrastructure you’ll build independently, regulatory and compliance costs, security measures, and ongoing system maintenance. On average, moderately complex software with additional features and security measures could cost from $300,000 to $500,000. Yet, a highly advanced and fully customized enterprise payment orchestration platform may cost way over $500,000.

It’s one of the main factors to consider when asking how much does it cost to start a credit card company, especially if customization and proprietary technology are key to your model.

White-label payment software

Alternatively, if you opt for a white-label solution, you’ll get ready-to-use software with licensing fees and customization costs. Generally, the price of a white-label solution customized to meet your specific branding, feature, and integration requirements may vary widely, ranging from $10,000 to $50,000 or more. It’s worth emphasizing that you will generate revenue much faster with a white-label solution since it’s pre-built and ready for use.

Our customers often note that a white-label solution allows them to go to market quickly without sacrificing flexibility. They can adapt the functionality to their business processes and scale the platform as their company grows.

How to Start a Credit Card Processing Company FAQs

Let’s take a look at the most frequent questions on how to start a credit card processing company.

How to choose a credit card processing company?

When choosing a credit card processing company, consider factors such as pricing transparency, supported payment methods, security standards and PCI DSS compliance, reliability of the technology, and scalability. It’s also important to evaluate integration options, settlement speed, geographic coverage, and the provider’s experience in your target industry.

What is a credit card processing company?

A credit card processing company enables merchants to accept card payments by securely transmitting transaction data through the payment ecosystem. It handles authorization requests, supports settlements, applies security and fraud-prevention measures, and provides the technical infrastructure required to process card transactions reliably.

How do I start a credit card processing company?

To get started, define your target market and business model, choose whether to build your own system or use a white-label solution, and ensure compliance with industry standards such as PCI DSS. From there, establish banking and payment partnerships, prepare your legal structure, and follow a step-by-step launch plan covering technology, compliance, and go-to-market strategy.

I want to start a credit card processing company — where do I begin?

Begin with positioning and scope. Decide which merchant segments you will serve, which regions you will operate in, and which services you will offer. Once the scope is clear, focus on compliance readiness, partnership strategy, and selecting a scalable technology approach that supports future growth.

How to become a credit card processing company?

Becoming a processing company requires operating as a regulated payments business. This involves setting up a compliant legal entity, meeting security requirements such as PCI DSS, partnering with acquiring banks or sponsors, and building operational processes for onboarding merchants, managing risk, and supporting transactions.

How to open a credit card processing company legally?

To open a processing company legally, you must choose an appropriate legal structure, understand the regulatory requirements in your target jurisdictions, and ensure full compliance with data protection and payment security standards. Legal and regulatory obligations vary depending on your business model and geography, so professional legal guidance is strongly recommended.

How much money do you need to start a credit card processing company?

Starting a credit card processing company can require a significant investment, with costs varying based on factors like business size, scope, and the services you intend to offer. On average, you might need between $50,000 to $500,000 or more. This includes costs for obtaining necessary licenses, compliance with PCI DSS and other regulations, technology infrastructure (payment gateways, fraud detection, security systems), and staffing. You’ll also need funds for marketing, legal fees, and operational expenses.

Do credit card processing companies make money?

Yes, credit card processing companies make money by charging fees for their services. They typically earn a percentage of each transaction processed, along with a fixed fee per transaction. Additionally, some companies charge setup and monthly fees for using their services.