- What is Payment Tokenization?

- Need for Payment Tokenization

- How Does Tokenization Work

- Existing types of payment tokens

- Benefits of Payment Tokenization

- Tokenization vs Encryption

- Where tokenization of payments is used?

- Options for Implementing Payment Tokenization

- Akurateco Payment Tokenization Solutions

- FAQ

As we step into the era marked by the rapid growth of digital payments, we also find ourselves faced with the growing challenge of payment fraud. According to estimates from Statista, e-commerce losses to online fraud were estimated at 41 billion U.S. dollars globally in 2022, up from the previous year. Moreover, it is expected to reach more than $48 billion by 2025, becoming a concerning trend for merchants and their customers.

To protect their businesses and clients from fraud, more and more merchants use advanced online payment technologies. At the forefront of this list stands payment tokenization. So, what is tokenization in payments? Payment tokenization is a process that securely replaces sensitive payment information, like credit card numbers, with a randomly generated token.

In this article, we will unveil the basics of tokenization, outline the primary benefits of tokenized payment, provide insights into how it works, and guide you on its seamless integration into your business operations.

What is Payment Tokenization?

First, let’s take a closer look at the tokenization definition.

Payment tokenization is a technology used in transaction processing to enhance the security of sensitive payment information, such as credit card numbers, by replacing them with unique tokens. This token is a random string of characters with no intrinsic value generated through encryption and secure algorithms.

Need for Payment Tokenization

A major driving force behind the need for payment tokenization is the increasing rate of fraud. When customers decide to pay for goods or services at the merchant’s website, they share their most valuable yet vulnerable information – payment data. The data entered by customers during checkout is much more susceptible to scammers’ attacks when sent for processing as originally entered. Therefore, it needs to be hidden from fraudsters with the help of tokenization.

Tokenization safeguards credit card data on a website or application, preventing it from falling into the hands of scammers who can use it for unauthorized transactions or to compromise the cardholder’s account.

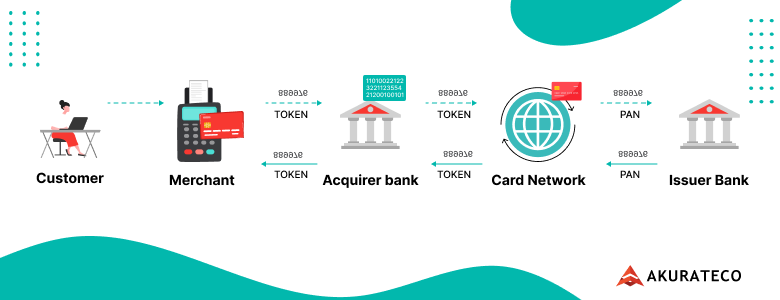

How Does Tokenization Work

How does payment tokenization work? Payment tokenization is a complex multi-stage process. It involves the following steps:

1. Data capture

When a customer pays for goods or services on the merchant’s website with a credit or debit card, they enter the card’s Primary Account Number (PAN), collected by the merchant or a payment gateway.

2. Tokenization request

Then, the merchant or the gateway provider encrypts this PAN and sends it to a tokenization system over a secure connection.

3. Tokenization process

The tokenization service processes the request and generates a unique token to indicate the client’s PAN. The generated token is a random string of characters unrelated to the original card information.

4. Token transmission

The tokenized data, which includes the generated token and transaction details, is sent back to the merchant or payment token service provider over a secure connection.

5. Token storage

When transmitted, the token is permanently stored in the merchant’s or the gateway’s database to be later used for transaction processing with the client’s consent to store their sensitive data. The merchant no longer stores or transmits the actual credit card numbers.

6. Transaction processing

Having received the secure token from a payment gateway, the payment processor sends it to the card network instead of the customer’s PAN number. The card network forwards it to the issuing bank.

7. Transaction validation

The issuing bank validates the token and verifies available credit, account status, and transaction authenticity. The card issuer approves the transaction if the token is valid and all checks pass.

8. Transaction completion

Finally, the processor receives the authorization and notifies the payment gateway. As a result, the transaction is completed, and sensitive card data is transformed into a secure token.

Existing types of payment tokens

In the payment processing system, payment tokens can be classified into several types, each serving a specific purpose.

Acquirer tokens

This type of token is generated and used by the acquiring bank or payment processor when they receive a payment processing request from the merchant. Generally, it is used to represent a customer’s sensitive card information during a transaction, allowing the acquirer to process the transaction securely.

Issuer tokens

Issuer tokens are generated and managed by the issuing bank on the customer’s behalf. These tokens are used in several cases, commonly associated with transactions conducted through digital wallets like Apple Pay and Google Pay and similar payment methods.

Network or scheme tokens

These tokens are generated by payment card networks (e.g., Visa, Mastercard). There are different token services operated by each card network, used to link the transaction to the appropriate network.

Payment tokens

A payment token is a relatively new variant of an issuer token, often generated within a token program framework and intended for specific use cases. The exact mechanism of payment tokens’ generation may vary between different payment providers and platforms.

Merchant tokens

This type of token is generated for merchants by their payment system provider. Merchant tokens enhance the checkout process for customers, making it more secure, seamless, and efficient. Additionally, they simplify recurring and subscription payments by eliminating the need for the customer to input actual card data for each transaction repeatedly.

Benefits of Payment Tokenization

Now that we know what is payment tokenization and how it works, let’s discuss the main benefits of this technology for merchants and buyers.

- Enhanced data security

When tokenization technology replaces customers’ sensitive card details customers with highly secure tokens, data security is significantly improved, enabling safe transmission and storage of payment information, even in the unfortunate event of a data breach. Even if the tokenized PAN falls into the wrong hands, fraudsters cannot exploit it for unauthorized transactions or gain access to cardholder accounts. Ultimately, this advanced security measure helps businesses protect customers’ financial information and reduces the risk of reputational damage due to data breaches, safeguarding businesses from potential financial losses and legal liabilities.

To learn more about other efficient fraud prevention technologies, read the article below:

Payment Fraud Prevention: Enhancing Online Payment Security with Modern Technologies

- Simplified PCI DSS compliance

Compliance with the Payment Card Industry Data Security Standards (PCI DSS) is crucial for businesses that handle cardholder data. However, achieving compliance can be challenging and resource-intensive, and not all online businesses comply with the necessary standards. How does tokenization work in payments to help with this? Payment tokenization allows merchants to reduce the scope of their PCI DSS compliance efforts. Since sensitive card data is replaced with tokens and a merchant does not store and transmit the actual sensitive data, it simplifies compliance requirements, leading to cost savings and a more streamlined compliance achievement process.

- Streamlined payment processing

Since tokens are random strings of characters unrelated to the actual sensitive card data, they do not need extensive encryption. Due to this, transactions can be processed faster, facilitating a smoother checkout experience and improving customer satisfaction. Payment gateway tokenization can further streamline the entire payment flow.

- Fortified customer trust and confidence

As merchants handle customers’ vital information — payment data — they have heightened concerns regarding its security. Opting for payment tokenization demonstrates a commitment to data security and customer protection, making customers feel more confident about making online purchases. Such trust and confidence can increase customer loyalty and repeat business, as clients are more likely to choose a business that prioritizes their data security.

Tokenization vs Encryption

Tokenization and encryption are both technologies used to protect customers’ sensitive payment information. Their purposes and mechanisms, however, differ.

Encryption is a technology that transforms sensitive data into ciphertext using an algorithm and a secret encryption key. Encryption requires robust critical management practices to safeguard keys. However, if the keys are compromised, the encrypted data can be decrypted, thus susceptible to fraud. Tokenization, in turn, is the replacement of payment data with a unique token that has no relation whatsoever to the user’s factual payment information. Therefore, a token is non-reversible, making it invulnerable to fraudulent attacks.

The use cases for these technologies also vary. Encryption is primarily used for secure data transmission from one payment processing party to another, while tokenization is used for secure data storage. The use of tokenization is common in subscription-based businesses, online retail platforms, and recurring payment scenarios, among others. Furthermore, tokenization and encryption can be used together for a layered security approach.

Where tokenization of payments is used?

Tokenized payments are used across various online business industries where sensitive payment data security is paramount. Here are some common use cases:

1. Subscription-based services

Businesses that offer goods and services on a subscription basis benefit significantly from tokenization as it simplifies recurring payment management. Tokenization technology eliminates the need for customers to repeatedly input their payment details, ultimately resulting in an improved and convenient customer experience.

To learn how tokenization and recurring billing payment technologies can enhance subscription billing efficiency, read the article below:

Optimizing Subscription Billing with Recurring Payment Technology

2. E-commerce

For online shopping and e-commerce, tokenization could decrease the cart abandonment rate. Cart abandonment often occurs when customers must repeatedly re-enter their payment details for each new purchase. However, with tokenization in place, customers’ data is already stored in the payment system, making a purchase seamless for them.

3. Recurring billing payment services

Using tokenization is a common practice among companies that issue recurring bills to their customers, such as utility companies or subscription box companies.

4. Travel and hospitality

The travel industry, including airlines and hotels, leverages payment tokenization to protect customers’ sensitive data during booking and check-out processes.

Options for Implementing Payment Tokenization

There are several options for merchants to start leveraging tokenization technology: they can involve a tokenization service provider, implement tokenization in their existing payment infrastructure, or choose a payment software provider that offers tokenization technology. Let’s explore all of them in detail.

Choosing a tokenization service provider

There are many tokenization payment services that cater to online businesses. If the company opts for this route, the merchant must comprehensively assess potential vendors when choosing their tokenization service provider. Also, they need to ensure that the selected provider is well-versed in industry compliance standards and employs robust encryption and key management practices to protect tokenized data.

While tokenization service providers offer significant benefits for enhancing data security in payment processing, there are also potential drawbacks to consider. Integrating a tokenization solution into your existing payment infrastructure can be complex, costly, or even technically impossible.

Relying on a third-party provider also means your business becomes dependent on their card tokenization services. Since they have your customers’ payment information under their control, switching to another provider will be difficult. Furthermore, if the provider experiences downtime, service interruptions, or security breaches, it can impact your ability to process transactions and potentially harm your reputation.

Implementing tokenization in your payment infrastructure

The second feasible solution is implementing tokenization within your current payment infrastructure. You can implement it independently in your own payment system. To do this, you need to plan the integration of tokenization into your current system carefully, ensuring that it aligns with your existing infrastructure and minimizes disruptions to your business operations. If you’re utilizing a payment vendor’s infrastructure, you can request them to manage the development for you.

Although this option offers the highest degree of flexibility tailored to your business requirements, it is also the most intricate and expensive one. The upfront costs of integrating tokenization into your payment infrastructure include software or hardware upgrades, developers’ salaries, staff training, and ongoing maintenance. Also, integrating tokenization can be challenging for businesses with legacy systems or complex payment architectures.

Furthermore, in the case of dependence on a third-party payment service provider, they may reject your request to implement tokenization if their system is not flexible in terms of additional developments.

Partnering with a payment software provider that supports tokenization

Another option for online businesses is to collaborate with a payment software provider offering a ready-to-use system that already supports payment tokenization. This option is easy to implement as it eliminates development expenses and third-party tokenization services integration. However, its features will vary depending on the vendor you choose.

Akurateco Payment Tokenization Solutions

Akurateco is a reputable provider of a white-label payments orchestration platform that incorporates advanced payment tokenization along with other innovative technologies, such as intelligent routing, cascading payments, built-in payment analytics, smart checkout, and over 500 integrated banks and payment providers.

Akurateco provides several tokenization options. Among them:

Card tokenization

Card tokenization is widely adopted in various industries. Businesses use it to protect sensitive data, reduce the risk of breaches, and create a pleasant checkout experience for their customers. It also reduces the scope of PCI DSS compliance requirements.

Recurring payments tokenization

Recurring payments tokenization involves the use of tokens to facilitate and secure recurring or subscription-based payments, where customers are charged at regular intervals for ongoing services or products. Recurring payments tokenization is commonly used in subscription-based services, membership platforms, utility bill payments, and various other scenarios where regular payments are required. They provide a secure and convenient method for businesses and customers to manage ongoing financial transactions.

Furthermore, within the Akurateco system, merchants can set up recutting schedules in the administrative panel and enjoy getting paid hassle-free, with no additional technical work on their side.

Custom invoices

Akurateco also provides an opportunity to configure custom invoice tokenization. This refers to the process of applying tokenization to custom-generated invoices to enhance security and streamline payment processing.

In practice, it works so that when the merchant sends their custom invoice to the client, and they pay it for the first time, their card is tokenized in the system. Next, according to the client’s recurring payment schedule, their subscription will be automatically charged. They will receive an email notification about the payment required and another after the payment has been made.

What’s more, Akurateco provides merchants with access to generated tokens in order for them to not be dependent on a specific system if they switch to another software vendor in the future.

If you want to fortify your business with payment tokenization and harness its full potential, feel free to book a Free Demo of our system.

Would you like to explore advanced payment tokenization technology by Akurateco?

Check out all its cutting-edge features and benefits here.

FAQ

How are tokens generated?

Tokens are securely generated by a tokenization service provider or payment system vendor. When customers enter their payment details at checkout, tokenization technology replaces them with a unique payment token.

What makes a token secure?

A randomly generated payment token has no direct association with the original card data, making it useless to potential attackers. Additionally, tokens are protected by robust encryption and security measures during transmission and storage. This way, they remain confidential and resistant to unauthorized access.

Is payment tokenization right for my business?

Tokenization is an efficient security tool suitable for businesses of various sizes and industries, especially those dealing with online transactions. There is a high probability that tokenization will benefit your company if you accept payments for goods or services online. However, to determine if it’s right for your business, it’s imperative to consider your specific payment processing requirements.

Does using tokenization make me PCI compliant?

Tokenization is a robust security measure that can significantly contribute to achieving PCI DSS compliance by reducing the volume of sensitive data stored. However, despite reducing the scope of PCI DSS requirements, it only covers some of the guidelines. To ensure all PCI DSS requirements are met, a comprehensive approach is necessary.

How does PCI tokenization work?

So, how tokenization works? PCI tokenization refers to the collective concept of a PCI DSS certified system equipped with tokenization technology. In the same way as regular tokenization works, the technology encrypts sensitive data and replaces them with secure tokens while also ensuring alignment with PCI DSS compliance requirements.

What is an example of payment tokenization?

An example of tokenization payment gateway involves using a unique token representing a credit card number during a customer’s purchase. Instead of entering the actual card number, the customer inputs a token generated by the payment system vendor or merchant’s tokenization system.

What is merchant tokenization?

Merchant tokenization involves the generation of tokens for merchants by their payment system provider. While created by a third-party provider, these tokens are transferred to merchants for storage. As a result, merchants have the flexibility to integrate these tokens into their customer experiences and business operations.