Establish your own payment facilitator service complete with a dedicated payment team at your disposal, all operating under your unique brand

PayFac as a Service

What types of businesses can benefit from PayFac as a Service?

Broaden your business’s horizons by introducing state-of-the-art technology tailored precisely to the requirements of a particular niche in new global markets.

Access 600+ Payment Connectors With a Single Integration

Unlock the potential of 600+ ready-to-run integrations to banks and payment options, and seamlessly integrate your existing ones for smooth transaction processing. Benefit from swift integrations, tailored adaptations, and the ability to link banks, merchants, and alternative payment methods (APMs) within a fortnight!

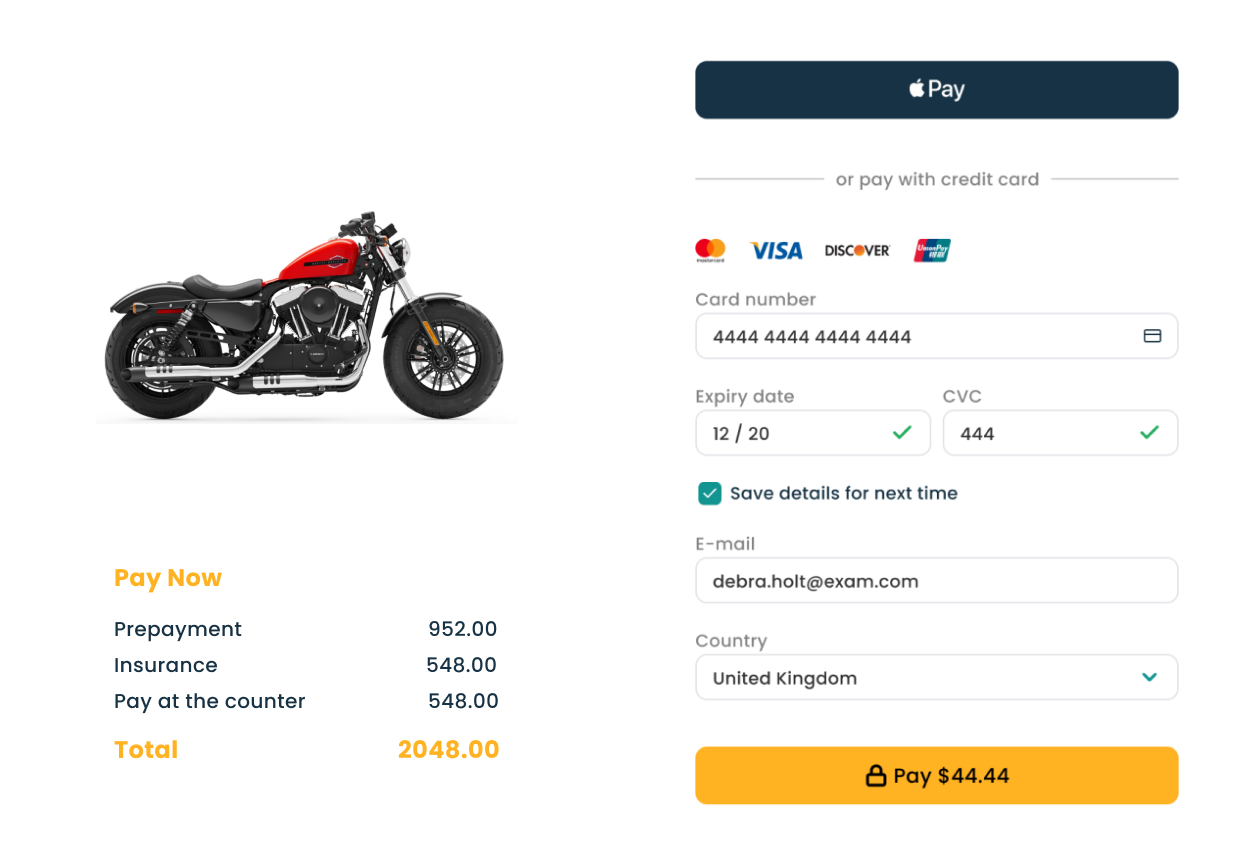

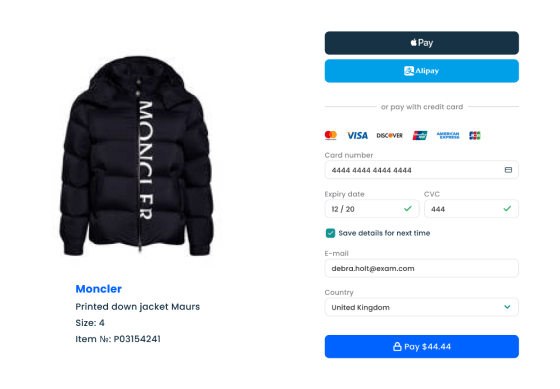

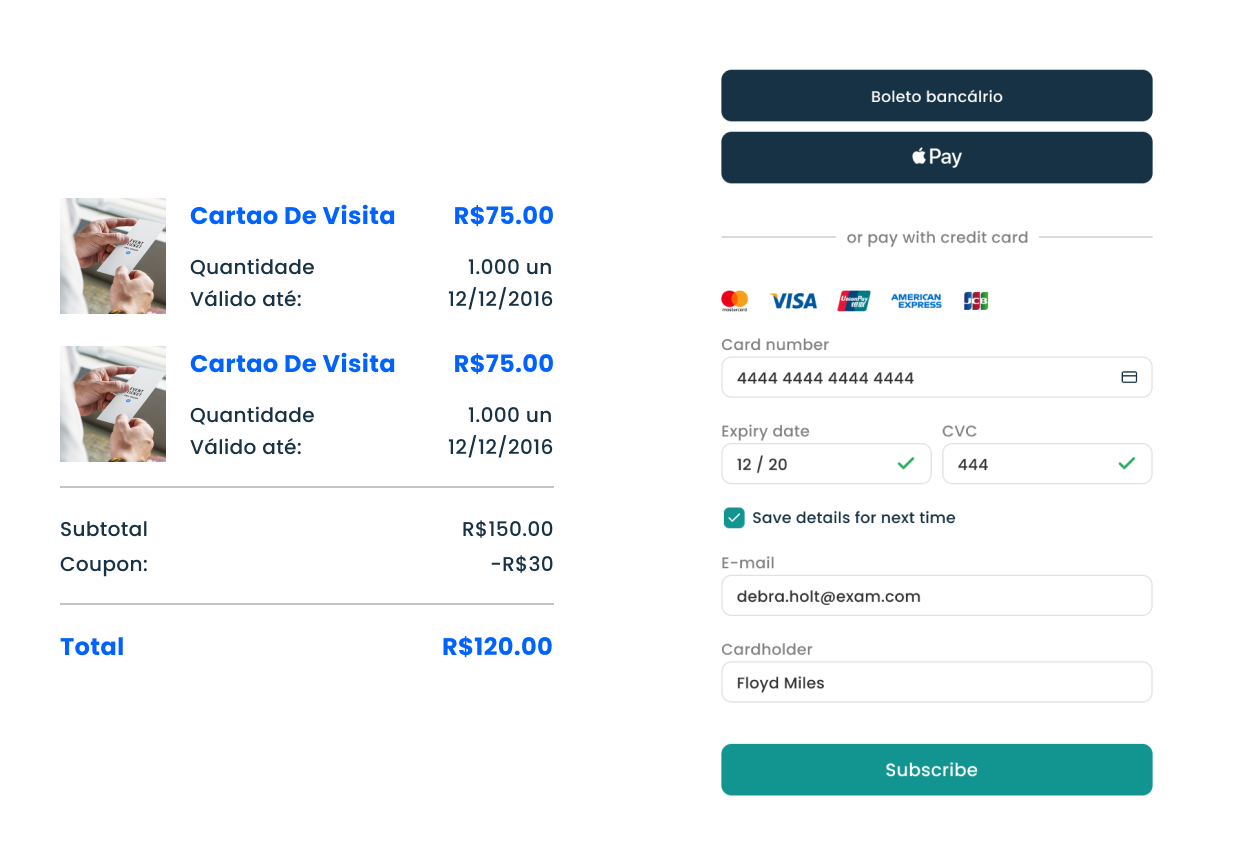

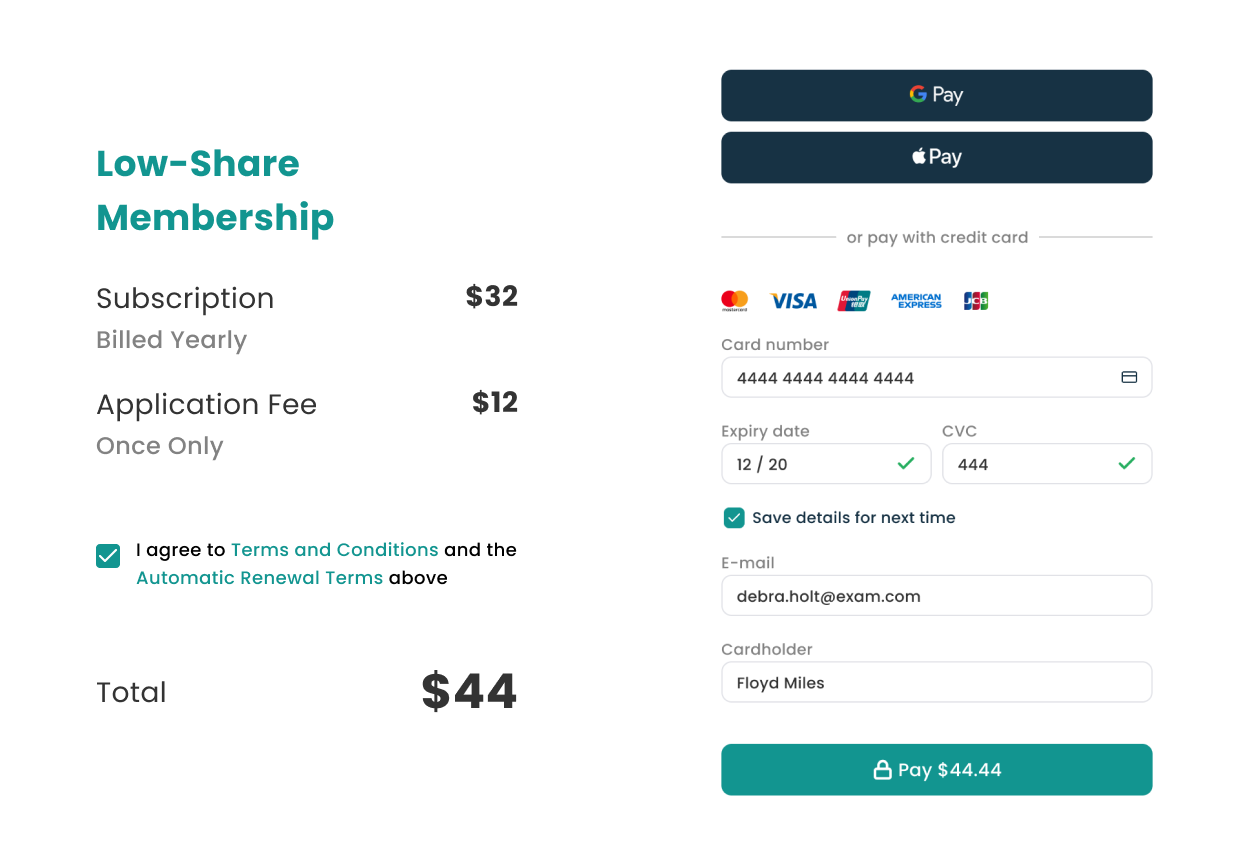

A System That Is Truly White-Label

Customize every detail of your white label PayFac platform to reflect your brand. Adjust payment page design, admin panel URLs, logos, button styles, and reporting formats to match your business identity.

Reporting and financial control with ease

Make data-driven decisions. Enjoy the comprehensive transaction reports, calculate your merchants’ fees, create settlements, and perform efficient reconciliation with the help of our PayFac management platform.

Features of PayFac as a Service from Akurateco

Elevate your transaction approval rate, effortlessly oversee multi-channel transaction flow within a unified platform, and formulate informed business choices using our cutting-edge PayFac solution.

A Dedicated Payment Team

Having a specialized team of payment professionals can be vital for seamless collaboration. Prioritizing punctuality, we leverage our extensive expertise and robust technology to guarantee a satisfying customer journey right from the outset.

Supercharge Conversions with a Best-in-Class Checkout Experience

Exponentially grow your conversion with our secure and easily customizable payment page. Build customers’ loyalty with a smooth transaction flow on any device, all as part of a powerful PayFac as a Service platform.

Localized payment methods

Automatically present the most relevant payment options based on the user’s IP address or selected language.

Proper multi-device experience

Ensure a responsive design that works flawlessly across desktop, tablets, and mobile devices.

Alternative payment methods

Dynamically offer mobile wallets, Buy Now Pay Later (BNPL) providers, and other APMs based on user behavior.

Network tokens

Improve conversions by securely storing and automatically updating card details for frictionless recurring transactions.

Complete customization

Fully align the checkout with your brand using SDK tools. Customize not only colors and logos but also directly embed the checkout within your existing design, host it on your own domain, and eliminate redirections for a fully native user experience.

PayFac as a Service by Akurateco

Harness the power of technology. Leveraging over 15 years of expertise in the payments sector, Akurateco crafts and manages a reliable, seamless payment platform for uninterrupted transaction flows.

SAAS or On-premise

Designed for high loads

Uninterrupted 24/7 Operation

Agile and Scalable Architecture

Continuous Enhancement

FAQ

What is PayFac-as-a-Service?

PayFac-as-a-Service refers to providing payment processing software for companies entering the payments market. Sometimes merchants who are seeking payment processing functionality refer to it as to PayFac but it’s not very accurate. This solution, like Akurateco’s, facilitates payment transactions smoothly through multiple connectors united in one system.

What is an example of a PayFac?

Akurateco is a great example of a PayFac, offering PayFac-as-a-Service to businesses. We provide a complete branded as a white-label payment processing platform, helping companies manage transactions efficiently.

How PayFac as a Service Works

PayFac as a Service, like Akurateco’s offering, provides businesses with ready-made payment processing software. Companies can integrate this solution into their platform, allowing them to offer seamless payment processing to their customers.

How long does it take to become a PayFac?

Becoming a PayFac varies depending on factors like regulatory requirements and technology setup. With Akurateco, you can access PayFac functionality quickly, with efficient onboarding and integration processes.

What is the difference between a PayFac and ISO?

The difference lies in their roles. A PayFac, exemplified by Akurateco, provides a complete payment processing solution, while an ISO (Independent Sales Organization) serves as a middleman between merchants and acquiring banks.

Why is Payment facilitation as a service the best choice for my platform?

Opting for Payment Facilitation as a Service, as offered by Akurateco, allows your platform to offer robust payment processing without the complexities. This ensures smooth transactions, efficient onboarding, and a seamless payment experience for your users.

Need Further Clarification?

Explore our comprehensive guide on starting a payment facilitation business, or book a call to experience the system firsthand.