Connect to over 600+ providers, optimize transactions, and maximize approval rates through a single payment orchestration platform.

How Payment Orchestration Simplifies Business Operations

Payments orchestration platform helps businesses streamline payment flows, improve conversions, and gain full control over global transactions — all through a single solution.

Maximize approval rates and minimize costs with built-in smart routing, cascading, and automatic updates.

Take charge of every transaction. Expand to new markets, set your own rules, and scale without building infrastructure from scratch.

Leverage 600+ integrations with banks, acquirers, APMs, and local providers worldwide via one integration to the platform.

Check out how leading businesses optimize payments with Akurateco

Orchestration Features for Optimized Payment Management

Leverage a powerful multi-provider solution by a global payment orchestration company designed to enhance payment efficiency, security, and flexibility.

![Go global with [connectors] payment integrations](https://akurateco.com/wp-content/uploads/2025/05/images-multi-currency.png)

Go global with 600+ payment integrations

Accept payments in local and international currencies using the most relevant methods worldwide.

Expand reach and increase conversions with over 600+ payment providers and banks.

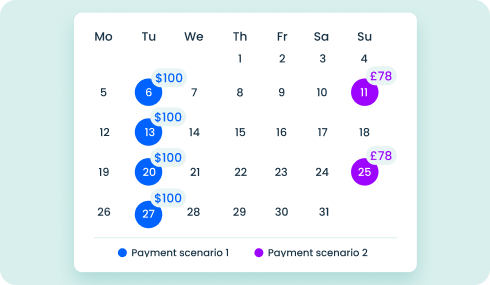

Maximize transaction success rates and cut processing costs

Automatically direct transactions to the best-performing provider based on parameters like cost, region, or card type with an intelligent routing engine.

If declined, retry instantly via alternative channels, ensuring successful processing within a single payment attempt.

Secure card data and unlock higher approval rates

Protect sensitive details at the network level, reducing fraud by up to 28% and boosting authorization by 3%.

Enable seamless recurring payments with automatic card updates when cards are reissued.

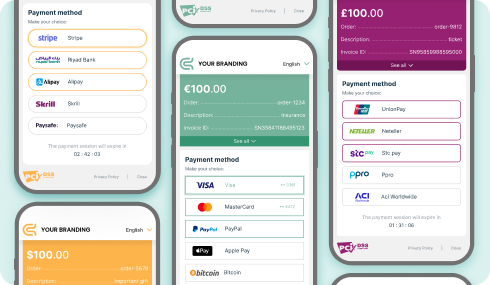

Boost conversions with a frictionless, fully localized payment journey

Dynamically display the most relevant payment options, including mobile wallets, BNPL, and APMs, on a fully customizable payment page.

Guarantee flawless performance across desktops, tablets, and mobile devices.

Align your checkout with your brand using SDK tools.

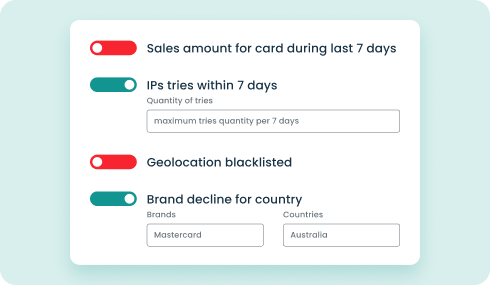

Stay ahead with data-driven fraud prevention

Monitor transactions with actionable insights and over 150 customizable fraud filters.

Built on 50+ years of combined expertise, our engine adapts to evolving threats in real time.

Get paid effortlessly — once or on repeat

Automate subscriptions with recurring payments and Pay by Link. Enjoy flexible billing options and tokenized Apple & Google Pay support. Or, collect one-time payments with secure links sent via email, chat, or SMS.

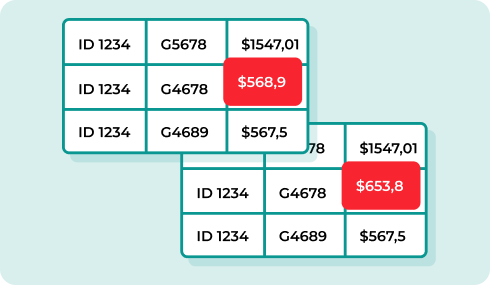

Simplify reconciliation with automated reporting

Match transactions across multiple providers and streamline settlement tracking with built-in automatic reconciliation.

Cut manual effort, errors, and reconciliation time while keeping your back office fully up to date.

Increase transaction approval rates by up to 30% with payment orchestration

Success Stories from Our Customers

Here are real-world cases where our customers have successfully expanded their payment infrastructure by embedding the payment orchestration layer into their ecosystem. These stories showcase how businesses solved key challenges and optimized their payment operations with our platform.

Explore How Payment Orchestration Benefits Businesses Worldwide

Learn how Akurateco’s payment orchestration platform offers access to 600+ payment methods, enhances conversion rates, and simplifies transaction management for merchants from various industries.

Boost Your Payment Performance Up to 30%

With Akurateco’s intelligent routing, each payment is automatically sent to the provider that is most likely to approve it.

And if the first attempt fails? Our cascading engine jumps in, instantly rerouting through backup channels to keep the payment and your revenue on track.

Why Choose Akurateco?

Proven performance, measurable results, and unmatched flexibility—everything you need from a payment orchestration provider.

Have we convinced you yet?

Let us showcase how our payment orchestration platform can optimize your business.

FAQ

What is a payment orchestration platform?

A payment orchestration platform is a payment system that centralizes multiple payment methods, gateways, and processors under one roof. This model streamlines operations, boosts approval rates, and simplifies global expansion.

What is the difference between a payment gateway and a payments orchestration platform?

A payment gateway processes transactions. A payment orchestration platform serves a much broader role. It is engineered to manage multiple gateways, route transactions, and optimize the entire payment flow.

How does the platform reduce processing costs?

Payment orchestration company cuts processing costs by routing transactions to the most efficient providers, reducing declines, and eliminating the need for in-house infrastructure and ongoing development.

How does a payment orchestrator increase approval rates?

With intelligent routing and cascading technologies, failed transactions are automatically retried with alternative providers, significantly boosting conversion rates.

Can I use Akurateco with my existing payment providers?

Yes. A payment orchestration platform is designed to work with your existing providers while giving you access to additional integrations. With Akurateco, you can connect your current acquirers, gateways, and APMs under one hub and combine them with over 600+ other global integrations we offer to optimise routing, reduce costs, and boost approval rates.

How long does the integration take?

Payment orchestration platform integration depends on your setup. On average, integration with Akurateco takes about one week. The exact time depends on the payment methods you plan to use. With our simple documentation, ready-to-use APIs, and a dedicated account manager by your side, we ensure a smooth and efficient onboarding process.

What payment methods are supported by the payment orchestration platform?

Payment orchestration supports multiple payment methods under a single platform. Akurateco offers 500+ integrations worldwide, including credit and debit cards, mobile wallets, bank transfers, crypto, and other alternative payment methods, tailored for both local and global markets.

Want to learn more?

We’ll show you the magic of payment orchestration