Payment analytics by Akurateco

The unified solution provides PSPs and merchants comprehensive transaction status and financial data on a single dashboard. Empower data-driven decisions for optimizing transaction success rates. Experience a new era of convenience and efficiency in data analytics with Akurateco.

Importance of Payment Data Analytics for Different Businesses

Merchants

PSPs

Banks

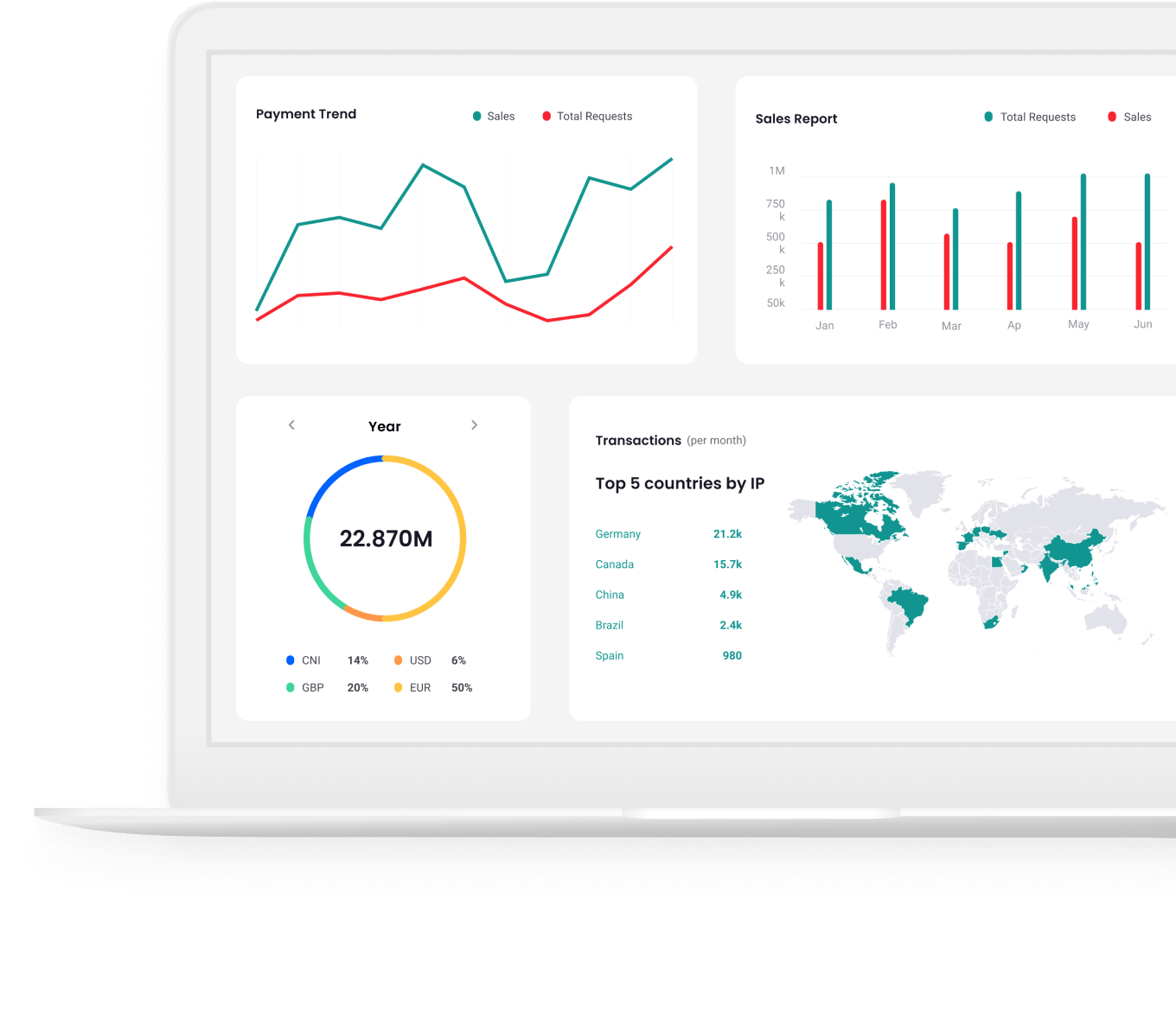

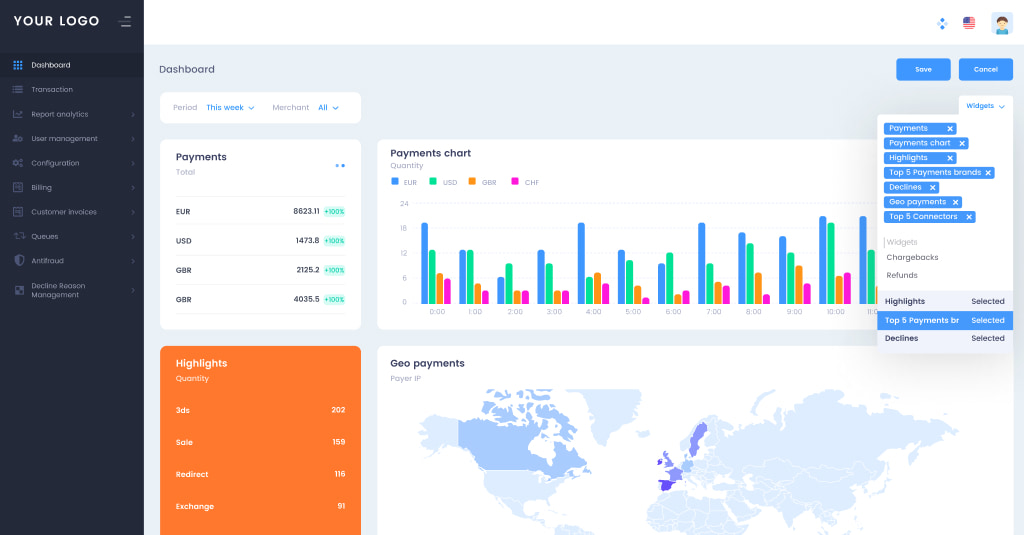

Payment dashboard for making data-driven decisions

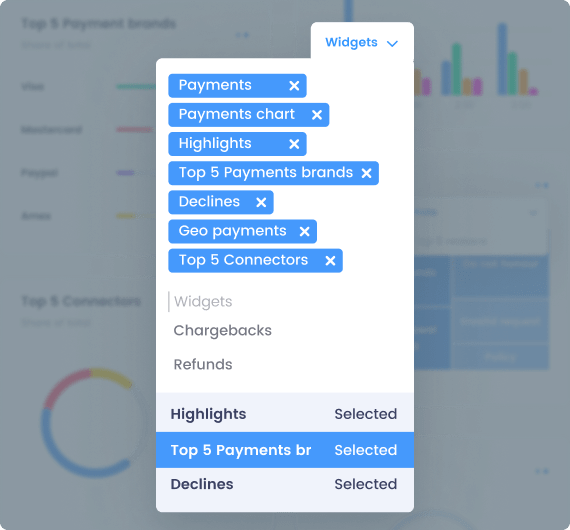

Elevate your business strategies with real-time transaction insights. Easily access transaction status, financial data, and trends on a unified payment dashboard that has different drag-and drop widgets. Data-driven decisions lead to optimized success rates and improved processes. Experience the future of analytics with Akurateco.

Benefits of Payments Analytics

Various kinds of graphics

Merchants reporting

Multi-use

Why choose Akurateco for payment analysis

Convenient Data Viewing

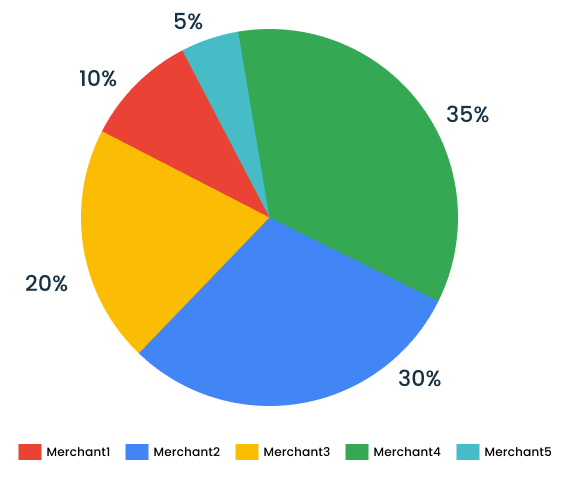

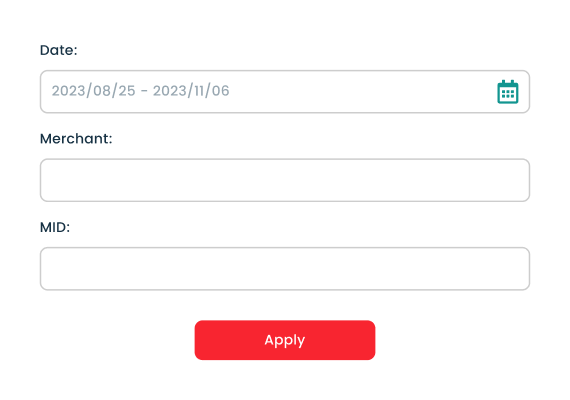

Use an additional segment layer to all reports (listed below), and get deeper insights into each and every merchant or even Merchant Identification Number (MID). You can also filter every report by merchants or MIDs.

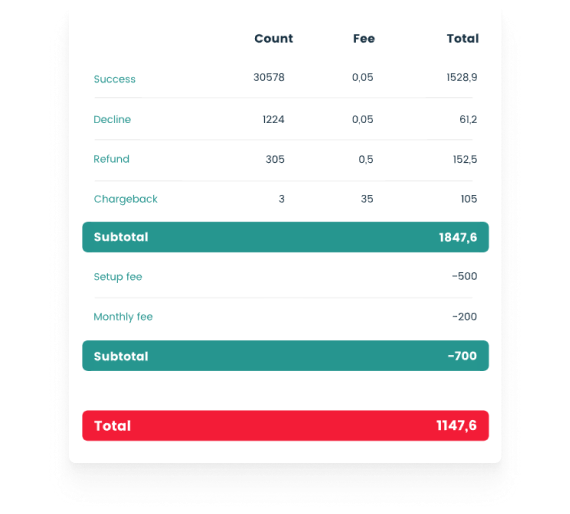

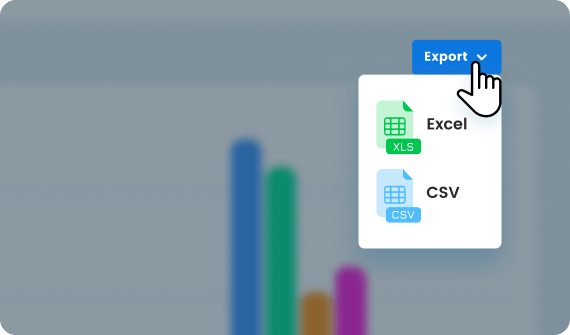

Effortless Data Export

Easily export CSV/XLS reports anytime, not just monthly. Our clients particularly appreciate this feature for settlements, and it’s also valuable for generating invoices!

Multiple export options

Extract and integrate data into your preferred business intelligence systems, such as Tableau, Looker or others.

Widgets for dashboard customization

Building the dashboard for analysis, our goal was to create something highly useful and simultaneously accessible. That’s why, with dozens of widgets on your dashboard, you have full control over them – from the ability to turn them off to a drag-and-drop editor. All to transform daily monitoring from a hassle into an enjoyable part of your workday!

Reports in action

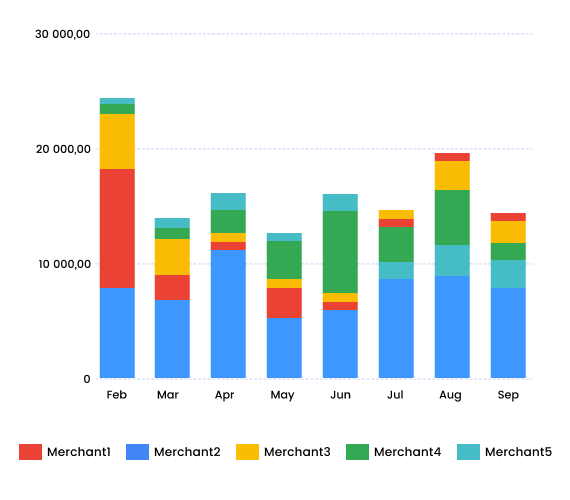

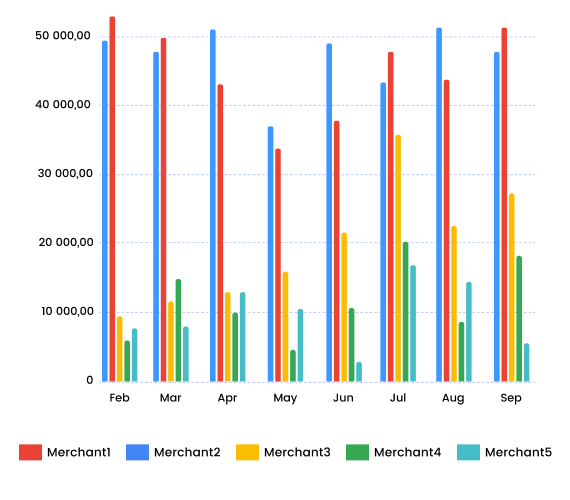

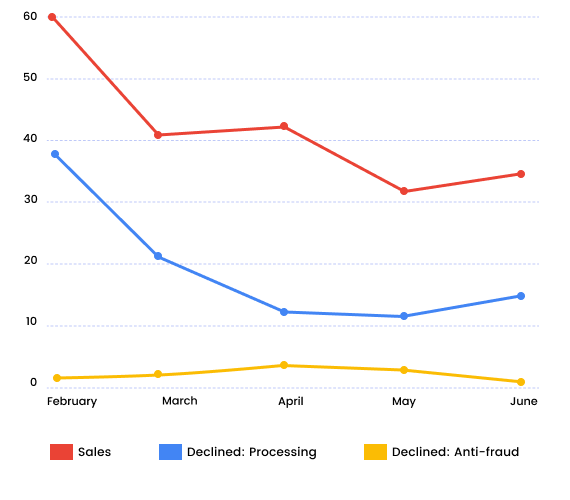

Sales Insights

Gain a comprehensive view of your sales performance. Identify both apparent and hidden growth opportunities, allowing you to strategize more effectively and enhance your sales efforts.

Chargebacks and Refunds

Monitor trends in chargebacks and refunds, minimize disputes, reduce revenue loss, and ultimately enhance customer satisfaction by providing a more reliable and secure payment experience.

Fraud Declines

Identify potential fraud patterns that can result in transaction declines. By strengthening your fraud prevention strategies, you can enhance the security of your payment processes and optimize transaction success rates.

Settlements

Effortlessly manage your settlements with our innovative and user-friendly payment platform. Stay fully informed about your invoice statuses, whether they are in the creation, sent, paid, or partially paid stages.

Payment Trends

Visualize three previous graphs of sales, declines, and fraud declines on a single comprehensive chart. This allows you to effectively track the progress of status changes on a month-by-month basis, providing you with valuable insights.

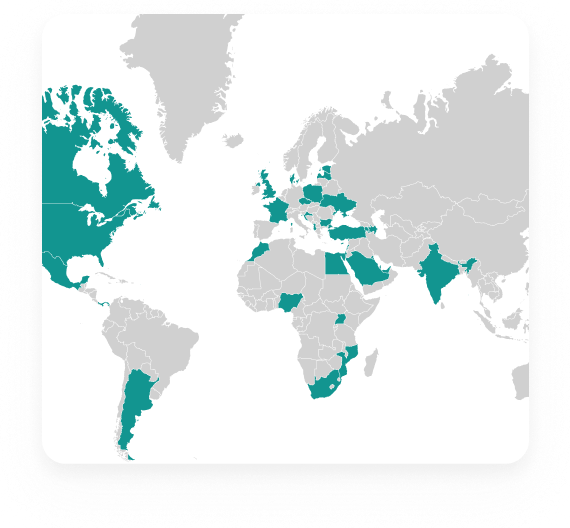

Sales by Сountries

A map displaying transaction statuses based on their country of origin. Also accessible to PSPs under individual merchants. Utilize this feature to identify high transaction volume regions for your business.

FAQ

What is payment data?

Payment data refers to the information generated during financial transactions, including details about the payer, payee, transaction amount, payment method used, timestamp, and more. This data plays a crucial role in understanding the financial activities within a business.

What is payments analytics?

Payment analytics involves the process of collecting, analyzing, and interpreting payment data to show insights and trends. It helps businesses gain a deeper understanding of their financial operations, customer behaviors, and market dynamics.

Why is payments data analytics important?

Payment analytics is crucial for merchants as it empowers them to make data-driven decisions. By understanding transaction patterns, success rates, and customer preferences, merchants can optimize their payment processes, leading to improved customer experiences and ultimately driving growth.

Also, payment analytics holds significant importance for PSPs as it allows to gain insights into transaction patterns, success rates, and customer preferences across their entire merchant base. This knowledge enables them to offer more tailored services to merchants, optimize payment processes, and enhance the overall value they provide to their clients.

What are examples of payment data?

Payment data includes transaction details such as the types of payment methods used (credit/debit cards, e-wallets, bank transfers), transaction amounts, currency conversions, success and failure rates, customer demographics, and geographic locations.

What is payment analytics software?

It’s a technological solution designed to collect, process, and analyze payment data. It offers tools and features to generate reports, visualizations, and actionable insights that help businesses make data-driven decisions about their payment operations.

How does your payment analytics service work?

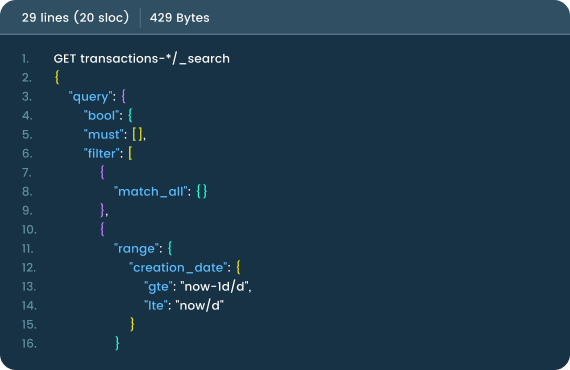

Akurateco’s payment analytics service gathers comprehensive payment data to analyze it in order to create intuitive dashboards, charts, and reports that provide insights into transaction trends, success rates, fraud detection, customer behaviors, and more.

Can payment analytics improve customer experience and retention?

Absolutely. Payment analytics enables businesses to identify and address friction points in the payment process, leading to smoother and more secure transactions. By understanding customer preferences and behaviors, businesses can tailor their offerings, resulting in improved customer experiences and increased retention rates.

What sets your payment analytics service apart from competitors?

We provide a unified dashboard with advanced analytics, fraud prevention insights, and customization options. Moreover, our 15+ years of expertise in FinTech ensures that the insights gained are actionable and impactful.

Need Further Clarification?

Explore our comprehensive payment analytics solution, or book a call to experience the system firsthand.