- What is payment routing?

- Static vs. Dynamic Payment Routing

- How intelligent payment routing works

- The main benefits of intelligent payment routing

- Akurateco Payment Routing: Taking your payments to the next level

- Real-life use cases: How Akurateco’s clients benefit from smart payment routing

- How to get started with Akurateco intelligent payment routing

- To sum up

- FAQs

With almost all goods and services delivered online today, a failed transaction isn’t just a technical hiccup — it’s lost revenue. Every declined payment can cost a business a sale, a customer, and long-term trust.

Intelligent payment routing, also known as smart payment routing, addresses this challenge head-on. It forms the core of modern payment routing infrastructure, enabling real-time decisions that reduce declines. By automatically directing each transaction through the optimal payment provider, businesses can boost approval rates, lower transaction costs, and ensure a smoother checkout experience.

In this article, we’ll explore what payment routing is, how it works (using Akurateco’s system as an example), real-life use cases from our clients, and the opportunities it presents to payment service providers and merchants worldwide.

What is payment routing?

Payment routing is a technology that automatically chooses the most relevant payment provider for each transaction, contributing to the company’s revenue and transaction approval ratio. This payment routing method helps optimize transaction outcomes, reduce latency, and ensure seamless processing. With advanced routing parameters, this technology replaced transaction processing prone to delays and declines on the payment processors’ side, internal limitations on certain types of transactions, their amount, blocked countries list, and other factors. It also enables card network optimization and supports multi-acquirer strategy for better authorization rates.

Watch the video below to better understand what intelligent payment routing is, how it works, and what benefits it brings for businesses.

Static vs. Dynamic Payment Routing

There are two main types of payment routing that businesses can rely on: static and dynamic. Let’s take a closer look at each of them.

What is static payment routing?

Static payment routing involves manual configuration of fixed routes. Unlike dynamic systems, these lack access to payment routing data, which is crucial for making real-time optimization decisions. A transaction is always sent to a predetermined payment service provider, regardless of system performance or conditions. If that provider experiences downtime or high latency, transactions fail, leading to lost sales and customer frustration.

What is dynamic payment routing?

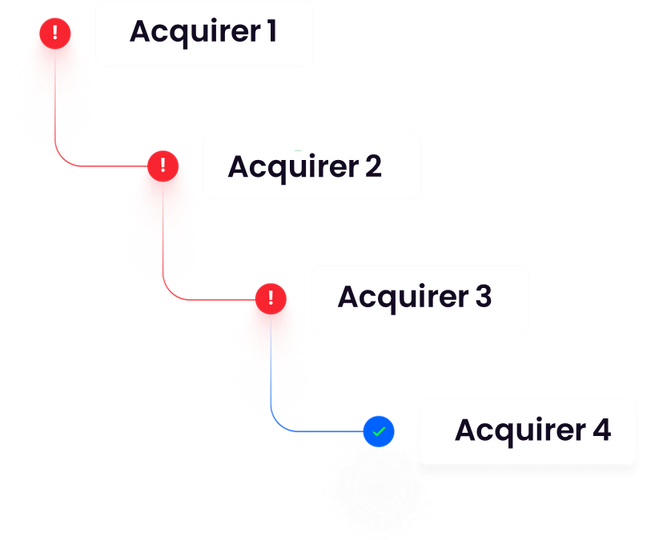

Dynamic payment routing uses real-time performance data to automatically choose the best available provider for each transaction. This form of routing for payment processing significantly boosts approval rates and ensures reliability in unpredictable environments. If a provider is down or declines a transaction, the system automatically redirects (cascades) the transaction to another provider within a single payment attempt, maximizing approval rates. This adaptive routing mechanism is key to approval rate increase and cost reduction.

In today’s fast-paced digital economy, dynamic payment routing is a must for businesses looking to optimize every transaction.

How intelligent payment routing works

Smart payment routing, a type of dynamic routing, allows businesses to manage payment orchestration efficiently via the system’s admin panel. The process begins with evaluating transaction data, such as BIN, currency, and amount, against various databases. Based on pre-set criteria, the system automatically selects the optimal payment provider for each transaction.

Once a customer confirms payment, the multi-step smart routing engine kicks in, acting as an intelligent payment router that evaluates each possible route to maximize efficiency. While configurations may vary by provider, the goal remains the same: to maximize approval rates, reduce chargeback risk, and ensure compliance with local and international regulations.

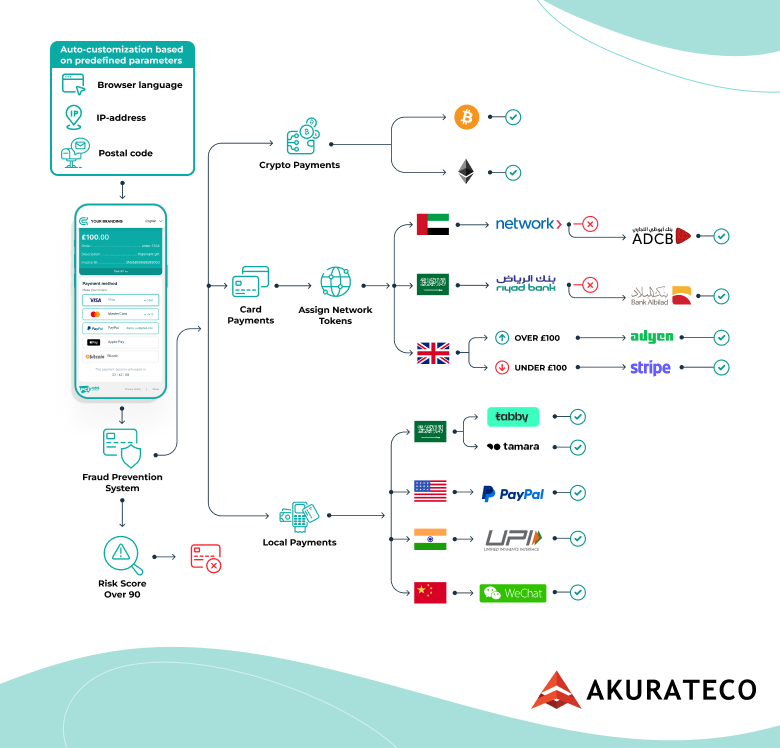

The diagram below shows how Akurateco’s Payment Routing solution works step by step.

- After the client confirms payment on the website or application, the automated fraud prevention system verifies the payment.

- If the payment is verified, the process of intelligent payment routing determines which payment providers could potentially process this transaction according to the payment method (shown in the image) or another given parameter.

- Based on additional parameters, such as the geolocation of the billing address, transaction amount, or low interchange fee, payment routing identifies the most suitable payment provider to route payment to and directs the transaction there.

- In case the transaction is declined due to issues on the payment provider’s side, a cascading mechanism activates, redirecting the transaction to another payment provider for processing. This process continues through multiple providers as needed, ensuring a successful payment within a single attempt and contributing to chargeback reduction.

The main benefits of intelligent payment routing

Akurateco’s CEO and Co-Founder, Volodymyr Kuiantsev, shares his insights into the transformative benefits of smart payment routing.

Intelligent payment routing is crucial for businesses to optimize transaction success rates and enhance the user experience. It’s a revolutionary technology in the world of payments that ensures transactions are processed efficiently and securely, regardless of any issues with individual providers. By dynamically selecting the best payment path, businesses can reduce payment failures, improve risk management, and increase customer satisfaction.

Now, let’s delve into the major benefits of payment routing in detail:

Reduced processing cost

Payment gateway routing reduces processing costs by sending transactions to payment providers with the lowest Interchange + and Interchange ++ fees that merchants pay for transaction processing. The fee amount differs depending on many factors, such as card level, type of card used, the issuer, the issuer’s country, etc. These elements directly affect how do card networks earn revenue and influence routing decisions. Accordingly, if the payment provider routes the transaction to a MID with a lower interchange fee, it captures more revenue. The system may also use smart routing to evaluate real-time analytics and route transactions to the most cost-effective processor, capturing more revenue.

Increased approval rate

The approval rate rises when the transaction is sent for processing to the payment provider or bank that is most likely to approve it. This is because it considers each payment connector’s limitations in processing certain payment types, such as from users whose countries are blocked or from high-risk industries, and does not send transactions for processing to such providers in the first place. This approval rate increase is also achieved through machine-driven logic and payment analytics for profitability powered by AI.

Enhanced transaction flow management

Besides the payment routing process, some white-label payment gateway providers like Akurateco also provide prerouting. It is a technology that enables routing transactions to MIDs based on data unrelated to credit or debit cards. Prerouting is used to allow routing transactions to Alternative Payment Methods (APMs). Prerouting to APMs can be done by currency, payer’s country, and other parameters, further enhancing the flexibility of routing payments transactions within a global strategy. Fundamentally, prerouting is an additional technology that helps users manage transaction flows. This allows for smart routing based on parameters like currency or payer’s country, and improves overall recovery rates for failed transactions.

Akurateco Payment Routing: Taking your payments to the next level

Akurateco is a white label payment gateway created by experts with 15+ years of hands-on experience in online payments that took into account all the problems faced by merchants and payment service providers in developing the performing intelligent payment routing technology.

Akurateco payment routing operates according to these parameters:

Geolocation of the billing address

To help the merchant save on processing fees, the smart routing payment gateway forwards transactions to local payment providers based on the geolocation of customers’ billing addresses. For our users’ convenience, the Akurateco system allows them to include and exclude specific countries regarding a particular MID or Acquirer.

Payment method

A customer’s payment is sent to the relevant provider group depending on whether they use a credit/debit card, Alternative Payment Methods (APMs), or cryptocurrencies. Then, based on your mappings, each transaction will be processed via the most relevant bank or payment provider within this group.

White Lists

There is an opportunity to send transactions from white-listed clients to the MID specified by the user.

Bank Identification Number (BIN)

BINs are used for identifying the card type and the Issuer Bank name to send transactions for processing to the payment connector that has the best success rate processing transactions from this issuing bank.

Bank Identification Number’s country

Transaction routing according to the BIN’s country stated in the BIN’s databases is also possible.

Credit/Debit Card Brands

By routing transactions to payment connectors that offer lower interchange fees for certain card brands, merchants can lower their overall payment processing costs.

Currency

Currency-based smart payment routing automatically sends transactions for processing to the most cost-effective Acquirer or MID based on the transaction’s currency. The technology considers exchange rates and fees to ensure the transaction is routed through the most efficient and cost-effective payment connector.

Transaction amount

Since each payment processor offers different rates for different transaction amounts, you can route a transaction to the most relevant payment provider based on this parameter.

Any routing parameter can also be added to the routing rules.

Akurateco provides an opportunity to set up an intelligent payment routing strategy according to any custom parameter that can be evaluated based on the collected data in the system and used to route the transaction to the specified MID or acquirer.

Also, users can combine the mentioned parameters when routing transactions. For instance, if a particular MID offers lower interchange fees for MasterCard in Slovenia, you can set this MID for routing such transactions, increasing profit.

Real-life use cases: How Akurateco’s clients benefit from smart payment routing

The businesses we are about to review operate in diverse sectors and geographical regions. Their real names remain confidential.

Client A: Routing FTD and Whitelisted Traffic Separately

Challenge: A PSP supporting global e-commerce lacked routing flexibility for first-time deposits (FTD) and whitelisted traffic, risking false declines and revenue loss.

Solution: Akurateco set up smart routing payments to send whitelisted traffic and FTD transactions to different MIDs, with automatic cascading on FTD declines.

Result:

- $150,000+ savings in system maintenance over one year.

- 11% increase in approval rate.

Client B: Balancing Transactions Across MIDs

Challenge: A global streaming service needed to distribute traffic evenly across two MIDs to avoid exceeding transaction limits.

Solution: Akurateco configured “Distribute by count” and “Distribute by percentage” modules for balanced transaction flow.

Result:

- No velocity limit breaches.

- Optimized merchant processing capacity.

- Increased number of successful daily transactions without system failures.

Client C: Optimizing Local and International Traffic

Challenge: A Qatari telecom provider needed to route local and international payments to different acquirers for cost efficiency.

Solution: Akurateco routed local transactions to the local acquirer (lower interchange fees) and international transactions to a more affordable international provider.

Result:

- 0.5% cost savings on every cross-border payment.

- Optimized interchange fees across all payments.

Would you like to know more about how we did it? Check out success stories below.

How to get started with Akurateco intelligent payment routing

Akurateco offers full support before, during, and after integration, including a dedicated account manager, technical assistance, and custom-built optimization strategies.

Getting started with Akurateco is simple and seamless. Here’s the process:

Step 1. Book a Free Consultation:

Schedule a free intelligent payment routing system demo with our experts to discuss your specific payment routing needs.

Step 2. Get a Customized Payment Optimization Plan:

We’ll design a routing and cascading strategy tailored to your business model, geographical footprint, and industry specifics, with a focus on payment routing optimization to minimize cost and maximize success rates.

Step 3. Go Live and Optimize Payments:

With dedicated support and a personal account manager, you’ll seamlessly integrate Akurateco’s system and start maximizing your revenue.

To sum up

Every failed transaction is lost revenue, and that’s a cost you can no longer afford to ignore. Intelligent payment routing isn’t just a technical upgrade; it’s a business growth strategy. From cost reduction to customer satisfaction and operational efficiency, it empowers your business to turn payment processing into a competitive advantage.

By switching to Akurateco’s smart routing and cascading solution, businesses across sectors have improved approval rates by 10–20%, slashed processing fees, and recovered revenue they were unknowingly losing every day.

FAQs

What is payment routing information?

Payment routing information refers to the data required to direct a payment transaction to the appropriate financial institution or payment processor. This information ensures that funds are transferred correctly and efficiently between the payer and the recipient.

What is smart payment routing?

Smart payment routing is an advanced payment processing strategy that uses data-driven algorithms to determine the best path for a transaction. It analyzes factors such as cost, success rates, geographic location, payment method, and processor performance to optimize the routing of each payment in real time.

How can smart payment routing reduce transaction costs?

Using a smart routing strategy, the system dynamically chooses payment providers with lower interchange and processing fees, minimizing costs per transaction.

Does the solution work with different payment gateways?

Yes! Akurateco’s platform integrates with 500+ banks and payment providers worldwide, making it one of the most versatile payment routing platforms available on the market today.

Can the system be integrated with our existing payment infrastructure?

Absolutely. Our modular, white-label technology allows seamless integration without disrupting your current setup.

How quickly can the solution be implemented in our business?

Integration time depends on complexity but typically ranges from a few days to a few weeks, with full support from our technical team.

How long does it take for a routing payment to go through?

The time it takes for a routed payment to go through depends on the payment method, processor, and routing complexity. For most card payments, the process is near-instantaneous, typically taking a few seconds to a couple of minutes. Bank transfers, such as ACH or SEPA, can take longer, ranging from a few hours to several business days, depending on the network and countries involved. Alternative payment methods, like e-wallets or buy-now-pay-later services, usually process quickly, though this can vary by provider.