White-Label Payment Gateway

Brandable Payment Software Suitable For Various Business Types

Expand your business into new international markets by offering cutting-edge technology fine-tuned to the needs of a specific niche.

Payment Providers

Launch and run your payment business with zero capital expenditures using our white label payment gateway software. Software development, infrastructure maintenance and technical support are on us.

Online Business / Merchant

Expand to new markets, maximize revenue and approval ratio. Grow your business while we take care of payment technology.

Marketplace / Platform

Embed financial service into your platform using our scalable white label payment gateway solution. Unlock additional revenue stream from embedded payment facilitation.

Banks / Acquirers

Serve your merchants efficiently. Merchant onboarding and compliance, customizable payment page, settlements, anti-fraud, third-party integrations and more.

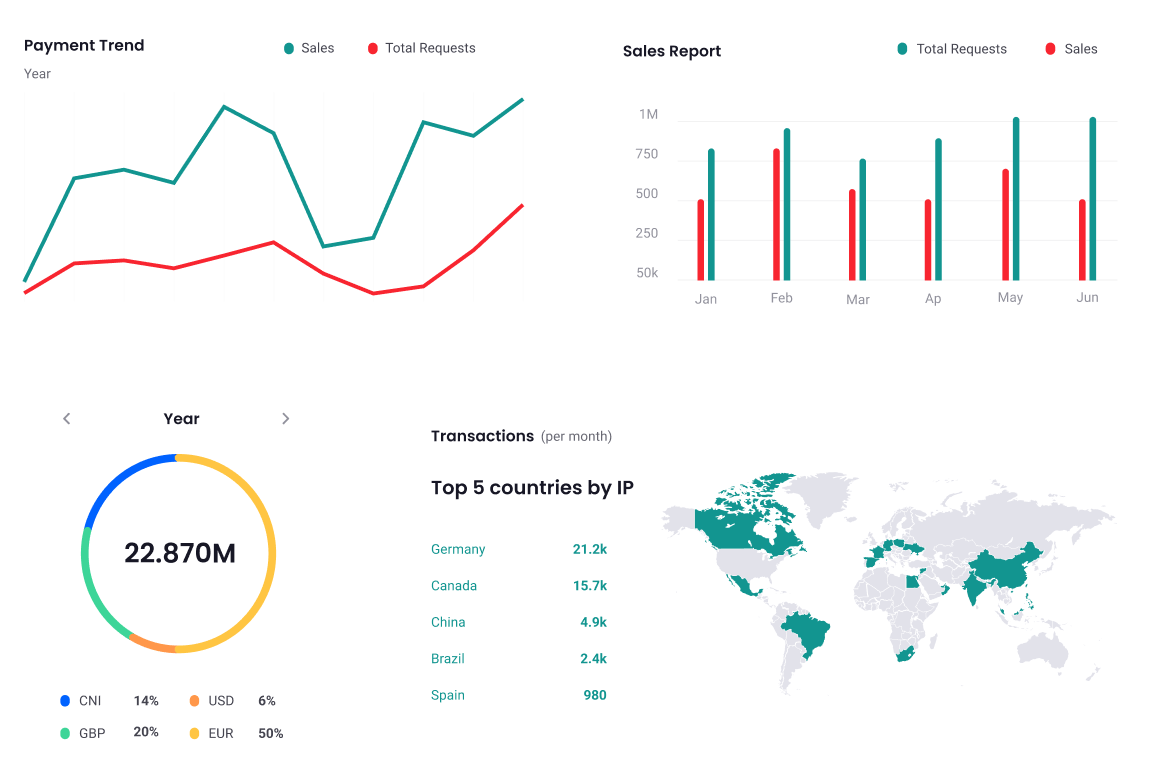

Keep All Data In One Place

Consolidated and easy-to-manipulate data management to keep you in full control over data from various payment channels.

Enhance Your Payment Ecosystem with Akurateco

Explore a suite of white label payment processing solutions designed to support and enhance your payment operations. Whether you’re starting a new payment gateway, scaling your current system, or seeking efficient payment orchestration, we provide the tools and technology to meet diverse business requirements.

Learm More About Akurateco

Discover How Akurateco Can Drive Your Business Growth

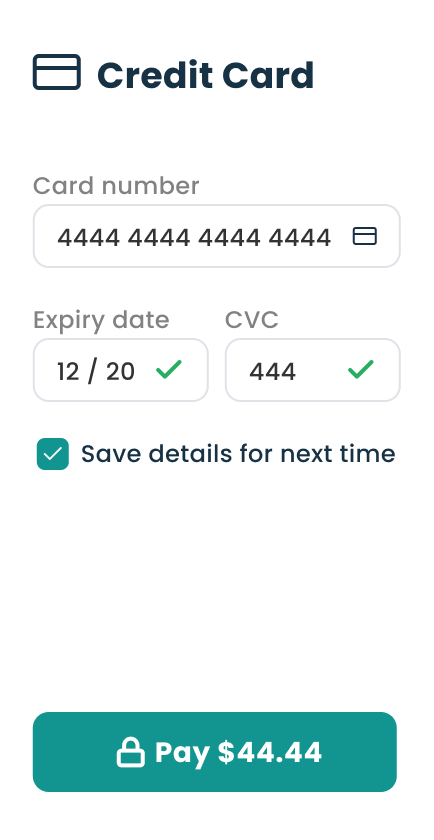

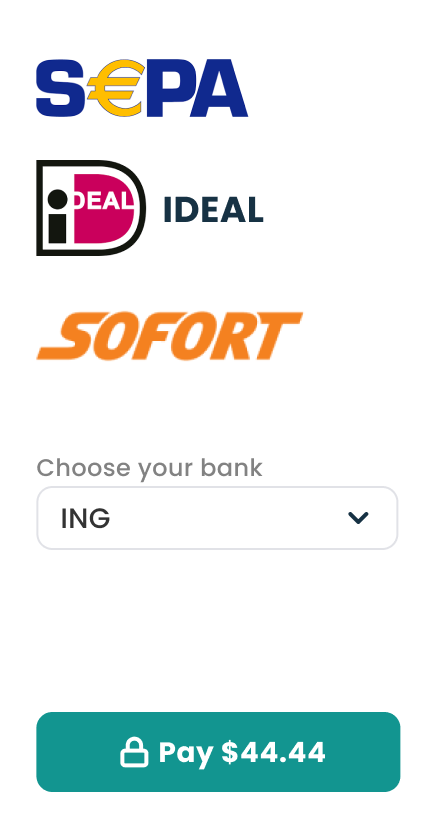

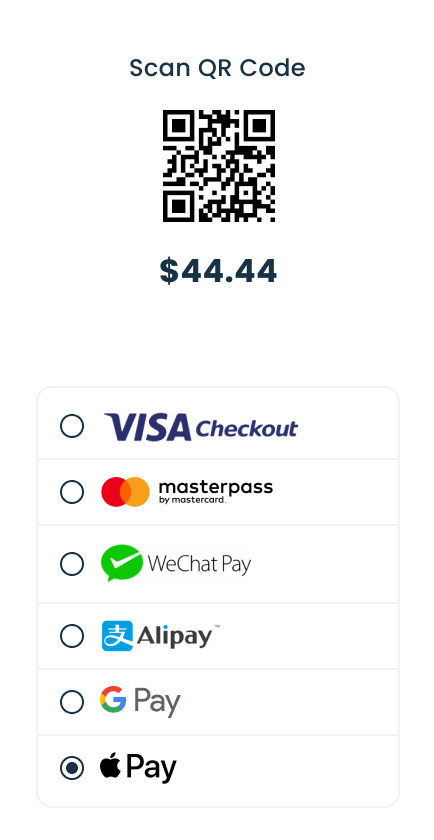

Personalize Your Customers’ Checkout Experience

Allow your customers to use their preferred checkout method to optimize their shopping experience, leveraging Akurateco’s white-label payment gateway provider infrastructure and scaling it up to meet their expectations.

Your Dedicated Payment Team — Without Hiring

We translate your business goals into a scalable payment strategy that supports growth, expansion, and profitability.

Backed by 15+ years of hands-on payment industry experience, we keep your payment flows stable, compliant, and optimised.

Stay ahead of regulatory changes with experts who understand international standards and local market requirements across regions.

Akurateco Support

OnlineHi! We've just connected another acquirer, and I'd like to set up routing & cascading.

Hello! What rules would you like to apply for routing?

I'd like all DE, BE, and FR traffic to go through MID 1 to optimise costs.

✅ Perfect, we can configure that. Let's schedule a quick call — I'll walk you through the setup and show you the best configuration options.

Enter a message

Results You Can Get With Akurateco

In-House Development vs. Akurateco's White-Label Software

Development Costs

Time To Market

Infrastructure Costs

Team

Payment Integrations

On-premise Setup

PCI DSS Certification

Payment Process Management

Maintenance & Upgrades

Fraud Prevention

Enjoy An Optimized Payment Solution

Case Studies

Our clients—ranging from established banks to agile payment service providers—each face unique challenges in the payments landscape. Our case studies showcase how we partner with them to build or refine payment systems that boost transaction approval rates, streamline payment flows, and elevate the end-user experience. Discover the real-world solutions we’ve delivered to meet diverse infrastructural needs.

Request A Free Demo Of The System Today!

Our Leaders

FAQ

Is Akurateco a payment gateway?

No, we are a fully brandable white label payment software. Our clients are PSPs that are looking to start their business or move from an old to a new platform, as well as banks, that need software to manage merchants efficiently.

Do you also offer acquiring/payment processing services?

We specialize in payment software development and maintenance. We can refer you to an acquiring partner of our company if we know the one that would be a good fit.

We do not, however, participate in financial flow per se, and this is not the service that we offer on a daily basis.

Do you offer white-label merchant services?

Yes. Our white-label merchant services provide businesses with a fully customizable payment system equipped with multiple payment methods and cutting-edge technologies – all under your brand.

What integration types do you support?

Your merchants can choose the type of integration that is suitable for their unique needs and capabilities:

- Mobile-ready Checkout that converts – smooth checkout to decrease your cart abandonment rate;

- Host-2-Host integration – allowing merchants to accept payment information on their payment pages;

- Plugins to CMS – ready-to-use plugins to the most popular CMS for easy integration of your merchants;

- Mobile SDK – iOS and Android SDK for merchants willing to accept payments in their mobile applications.

How long does it take to “go live”?

The dashboard setup takes up to 5-7 days as long as the connectors are integrated. In the meantime, integrating a white-label platform on-premise depends on the client’s infrastructure. Therefore, the setup time is calculated on a case-by-case basis.

What are your fees? Do you charge a monthly, per-transaction, or setup fee?

Each client’s specific fees and expenses are negotiated, and they depend on the volume of transactions, the product they choose, and the integration style they like.

Can I request a new connector?

Of course. Depending on the complexity of the documents and the pace of contact with the technical team of the relevant payment system, the integration will take 10 to 20 business days.

Do I need a financial license to work with you?

As a technology provider, Akurateco does not require you to be licensed to be able to use our gateway. To operate your firm successfully, you must, nevertheless, abide by your regulator’s and acquirer’s document-related standards.

In the event that you act as a payment facilitator and handle transactions through your accounts, your acquiring bank would often want a financial license.

A license is not necessary for your line of work, but, if you act as an Introducer with your acquirer or if you are a merchant using our gateway to manage payments.

Do you have a white-label reseller program?

Yes, we do. As a white-label payment software provider, we offer an Affiliate Program for partners willing to introduce clients to us.

What is a white-label payment gateway?

A white label payment gateway is a customizable payment processing solution that businesses can rebrand as their own. It allows them to offer payment services to their customers under their brand name (colours, fonts, style, etc) without developing the technology from scratch.

How to choose a white label payment gateway?

When selecting a white label credit card processing, consider factors like customization options, security measures, payment methods supported, and integration ease. Ensure it is flexible and can adapt to your evolving business needs.

What is a white-label billing system?

The term refers to the process of branding and customizing billing services as your own. It enables businesses to present invoices and payment requests to customers under their brand name, reinforcing their identity.

What are the advantages of utilizing a white label payment gateway solution?

The advantages of white label payment gateways include quicker time-to-market, cost-effectiveness, enhanced customer trust through consistent branding, and the ability to focus on core business. This all is possible while relying on high-quality payment solutions.

Why use a white-label payment gateway?

Businesses choose white label credit card processing to provide seamless and secure payment experiences under their brand. It empowers them to establish a strong brand presence and gain a competitive edge in the market.

How can white-label merchant services from Akurateco benefit my business?

By using our white-label merchant services, your business can quickly enter the market with zero development costs and minimal effort. Our system helps you expand your offerings, attract clients, and increase revenue streams with a robust, reliable, and fully branded payment solution.

What branding options are available?

White label payment gateways offer various branding options, such as customizing payment pages, using custom URLs, and tailoring customer communication. These options ensure businesses can deliver a cohesive and personalized payment experience to their customers.