In an era where completing an online purchase takes mere moments compared to visiting a brick-and-mortar store, crafting the ideal checkout user experience holds immense significance for online business owners. The reality is that offering only Visa and Mastercard as payment options is no longer sufficient. To truly stand out from the competitors, you need to delve into the realm of predicting and catering to your users’ individual payment preferences.

In this article, we’ll explore how the checkout experience affects payment conversion, uncover the user’s perspective on the perfect checkout and provide practical insights on effortlessly achieving it through leveraging smart checkout technology.

How does the checkout experience affect payment conversion?

To provide a comprehensive understanding of the perfect checkout experience, we will illustrate it through two different scenarios of online store purchases, allowing you to determine which scenario resonates with you the most and is more likely to motivate your purchase decision. This technology ensures that businesses never store raw cardholder data, reducing fraud risk and making it a vital tool for any credit card processing business looking to safeguard payment information and maintain customer trust.

Once you confirm your purchase in the first worldwide online store, you are directed to the payment page. However, you notice that the fields on the payment page appear in a language different from your browser, as shown below.

Also, among the available payment methods are only credit cards, while you mostly pay with digital wallets. Despite this limitation, you are still inclined to buy a product, so you select the acceptable credit card option, take your time to enter the payment information, and click “pay.” Unfortunately, the transaction does not go through for some reason. Lastly, you are redirected back to the payment page, forced to re-enter your payment details once again.

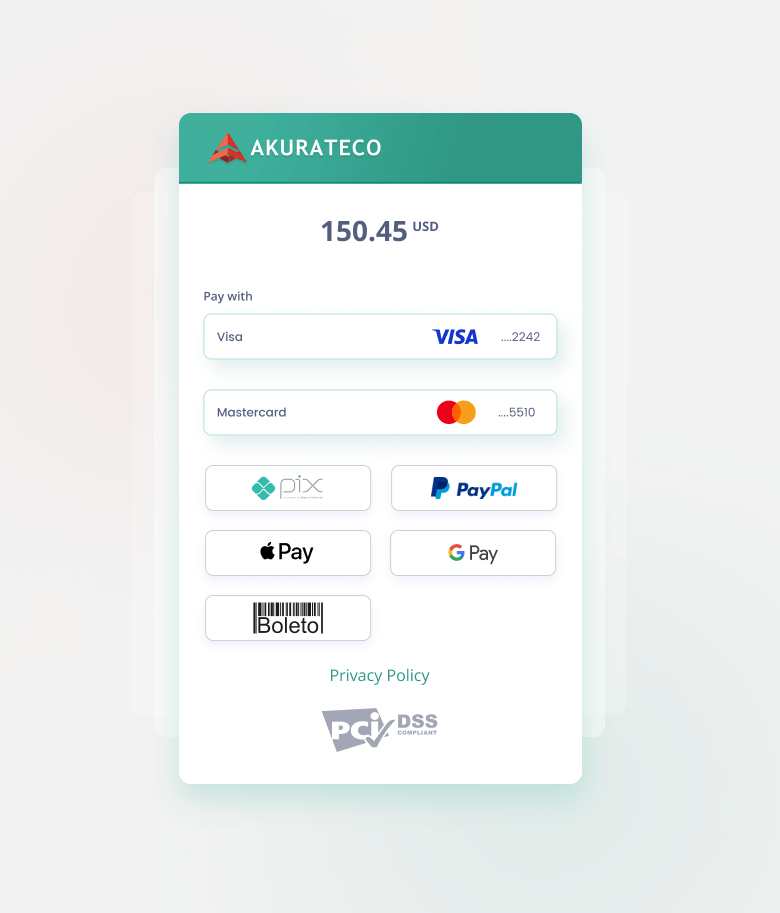

In contrast, the second store you are considering offers a much more user-friendly experience. The payment page is presented in the same language as your browser, eliminating language barriers. In addition, the store provides a comprehensive list of payment methods, listed below, that are widely used in your region, including the ones you frequently rely on. This smooth integration of various payment options is key for a credit card processing business, ensuring that customers can make payments in the most convenient way possible, enhancing conversion rates and customer satisfaction.

Opting to pay with GooglePay, you discover that the transaction is completed within seconds.

Now it’s your move. Given the contrasting checkout experiences described, which store would you prefer for your purchases: the first store or the second one?

Based on Akurateсo’s experts’ 15+ years of online payments experience, we can confidently say that customers will prefer the second option. As a result, the conversion rate of the first store will experience a significant decrease. In contrast, the second store, on the contrary, will witness a notable increase in its revenue.

Next, let’s get down to the specifics. What exactly are the key components that contribute to creating a perfect checkout experience?

Checkout experience: What makes it perfect

Several components contribute to a perfect checkout experience.

User-friendly payment page with your branding incorporated

When visiting the checkout page for the first time, the initial impression the client receives is primarily based on its appearance, including visuals, the interface, and the language used. In an ideal checkout scenario, the payment page should instill customer trust while prioritizing the utmost user-friendliness. To achieve this, its visual has to align with the brand identity and use its colors and style. The next step is ensuring the user-friendliness of the page’s interface by presenting only essential information and elements, removing all unnecessary fields, and providing clear instructions on completing payment. Lastly, the page language needs to adhere to browser language, geolocation, or personal preferences.

Payment options adapted to clients’ preferences

Whether or not customers will pay for your product or service directly depends on the payment options you offer them. However, identifying the most relevant payment methods for different customer segments from a wide range of options is more challenging than it may seem at first sight. To be able to do this, you will require a modern payment system with many integrated payment methods, as well as tools such as payment analytics, routing, and smart checkout, accompanied by a skilled payment team. With these technologies incorporated and based on a preliminary analysis of the client’s payment preferences, customers can be offered the most appropriate payment methods at the payment stage. Payment preferences can be tracked primarily by the customer’s transaction history, behavioral patterns, location, popular payment trends, and other parameters.

Correct order of payment methods displayed

In addition to accurately determining the most effective payment methods, arranging them in order of popularity and usage is crucial for enhancing customer satisfaction and maximizing conversion rates. By prioritizing payment methods based on customer preferences and behavior, merchants can strategically present the most preferred options at the forefront of the checkout process, encouraging customers to pay in the most convenient way for them.

To illustrate, let’s consider a scenario from the picture above where the buyer is a customer from Portugal, aged 50 or above, with a transaction history primarily comprised of bank payments. In such a case, the first payment method listed will be bank transfers, reflecting the customer’s established preference. Then, the system will present ApplePay, the region’s popular and widely-used payment method. Finally, the less commonly utilized payment methods will be displayed, providing the customer with additional options.

Fast and error-free transaction processing

Seamless and hassle-free transaction processing is the final yet crucial aspect of a smooth checkout experience. It plays a pivotal role in determining whether the client will choose to return to your website or application in the future, as customer satisfaction and trust are enhanced when transactions are processed smoothly, with no unexpected issues or delays.

Now that we have identified what makes checkout stand out, let’s delve into the tools to achieve it.

Akurateco’s smart checkout technology: Optimizing payment experience

Among the most efficient technologies that payment solution providers offer is smart checkout which aims to optimize the payment experience for users, eliminating any friction or hurdles that may arise along the way. Simply put, this technology is designed to take the burden of fine-tuning checkout off merchants’ shoulders.

To illustrate the concept of smart checkout, we will use the cutting-edge Akurateco payment orchestration platform developed to meet current merchants’ and payment service providers’ requirements.

Akurateco smart checkout technology provides features such as:

Adapts to the customer’s browser language

To enhance the client’s convenience, the system automatically detects the customer’s browser language and customizes the checkout language according to it. By identifying the browser language, the system ensures that the entire checkout process aligns with the client’s preferred language.

Customizes payment methods fields

As each payment method requests specific information, such as credit/debit card number, CVV code, bank account details, or digital wallet credentials, they require particular fields. Smart checkout technology dynamically adjusts them based on the selected payment method at the data input stage, presenting only the relevant fields to the customers.

Tokenizes credit/debit cards

Akurateco’s payment orchestration platform also offers tokenization technology, i.e., safe storage of customers’ sensitive payment information in the form of nonsensitive data called “tokens.” As a result, if a customer agrees to save their payment details, they will enjoy a better payment experience as there will be no need to re-enter their payment information each time when paying on the merchant’s website, only the 3DS password. This streamlined process not only saves time and effort but also contributes to a more secure and efficient checkout.

To learn more about how tokenization can protect your clients’ data, read the article below:

Credit Card Tokenization Vault – Protect Your Clients’ Card Data

Offers fast and seamless transaction processing

Since the payment experience extends beyond the checkout stage, what happens right after is of significant importance. To ensure a satisfying experience, a customer’s transaction should go smoothly. Therefore, fast and efficient payment processing becomes a “must” for merchants.

Akurateco’s payment orchestration platform is designed to streamline payment processing, increase the transaction approval rate and maximize payment conversion by up to 20%. To discover all its revolutionary technologies, read the article below:

Revolutionizing Payment Processing: The Power of Payment Orchestration

To wrap it up

A seamless payment experience is a fundamental driver of revenue generation and the key to building long-term relationships with customers, and an optimized checkout plays a vital role there. A reliable payment partner like Akurateco that offers smart checkout technology can help you create a superior payment experience hassle-free. If you would like to experience the benefits of a seamless payment experience for your business, feel free to book a Free Demo with us.