- Understanding the Basics of Payment Orchestration

- Why Do We Need Payment Orchestration?

- Who Uses Payment Orchestration? Business Cases

- Payment Orchestration Features That Unlock New Opportunities

- Benefits of Payment Orchestration for Modern Businesses

- How Can Akurateco Help Your Business Enhance and Grow?

- FAQ

As digital commerce continues to grow, the payment landscape is becoming increasingly complex and demanding. Rising costs, fraud risks, failed transactions, and the need to deliver seamless customer experiences put pressure on every business. To remain competitive, companies must find the most effective ways to enhance their payment systems.

Payment orchestration streamlines the entire payment ecosystem. It consolidates all payment providers and methods together in one place, helps reduce costs, boost approval rates, and empowers companies to scale globally.

In this article, we’ll provide a clear understanding of who uses payment orchestration and explain how payment orchestration features and benefits facilitate effective payment management, empowering businesses to stay competitive.

Understanding the Basics of Payment Orchestration

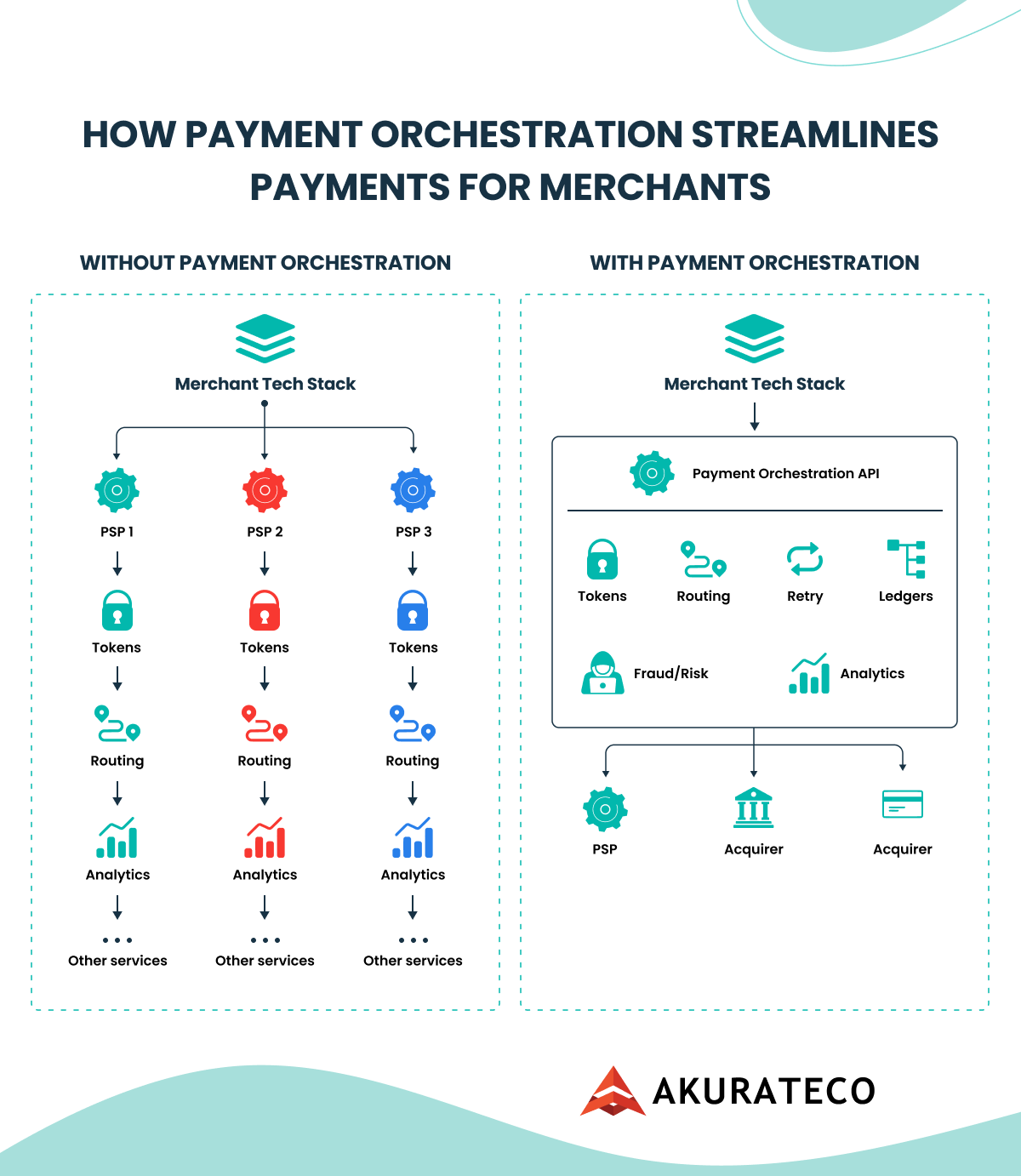

If a business wants to accept payments, it usually needs to connect to many different providers. This includes Banks, card acquirers, gateways, digital wallets (Apple Pay, Google Pay), Buy Now Pay Later services, and cross-border payment systems. Doing this one by one is complicated, expensive, and hard to manage.

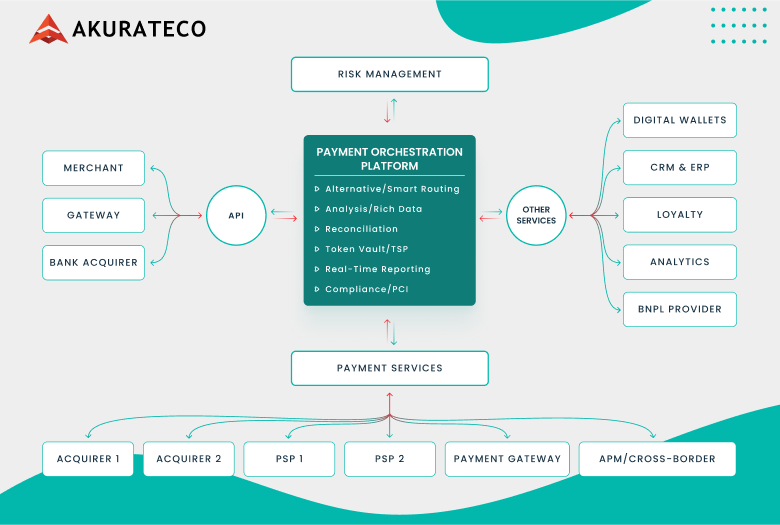

Payment orchestration puts everything in one place – all providers, acquirers, and methods are available under one roof. The business connects just once, via a single API. The platform then talks to all banks, gateways, and services on their behalf.

This unified infrastructure comes with the latest technologies for seamless workflows. Built-in tools ensure higher approval rates, secure payments, prevent fraudulent transactions, facilitate accounting, provide actionable analytics, and enhance the customer experience.

In a world where every transaction matters, payment orchestration enables businesses to gain a clear understanding of their payment flows, optimize performance, and confidently navigate their path to growth.

Why Do We Need Payment Orchestration?

As your business grows, it’s only a matter of time before you’ll feel overwhelmed with escalating payment complexity. A lack of alternatives can strangle your business. Every failed transaction results in wasted resources on high fees and unsatisfied customers.

Managing data across multiple providers, currencies, and methods without a centralized system creates chaos. Eventually, scaling can become almost impossible, which is especially important for commerce businesses.

Payment orchestration effectively addresses all these challenges. Moreover, it turns those struggles into opportunities, becoming a powerful driver of growth.

Orchestration provides a resilient and scalable infrastructure that ensures seamless transaction flows, both locally and internationally. Rather than being tied to a single provider and restricting the full potential of your payment performance, integrations with multiple acquirers and methods empower you to optimize costs, maximize approval rates, and deliver a seamless customer experience.

Explore Akurateco’s payment orchestration platform to transform your business today and unlock new growth opportunities.

Who Uses Payment Orchestration? Business Cases

Payment orchestration features make it well-suited for businesses of different sizes, industries, and goals. Let’s examine who uses payment orchestration and its impact on their operations by evaluating the following use cases.

Growing merchants

If a merchant relies on a single gateway, it can quickly become a bottleneck once they decide to expand their operations. Scaling requires setting up multiple connections and additional resources.

Orchestration supports growing businesses and provides a ready-made software for managing multiple providers, acquirers, and payment methods in a unified interface. This ensures optimized workflows, adherence to compliance regulations, lower costs, and customer satisfaction.

Scaling enterprises

Among the typical audience that uses payment orchestration are large enterprises. They often struggle with multiple integrations, high costs, and complex compliance requirements.

Each market requires a different provider to meet local payment preferences and regulations. Without orchestration, you risk failing. Fragmented reporting, increased operational overhead, wasted resources, and limited visibility into performance undermine growth and put profitability at stake.

Payment orchestration centralizes all data accessible via a single interface. It brings clarity about your online payments. As a result, you can streamline management across your payment workflows, improve efficiency, and lay a solid foundation for future-proof growth.

SaaS platforms

Ensuring smooth recurring bills and serving customers worldwide are top priorities for SaaS platforms. At the same time, they are the biggest challenges. Even a single failed transaction can lead to churn and lost revenue. Furthermore, a global customer base expects multiple payment methods, which requires companies to guarantee local compliance and reliable cross-border processing.

Payment orchestration connects to multiple providers through one API. It routes each transaction to the best-performing payment provider based on several parameters, including location, lower processing fees, and higher uptime. If one provider is down, the system switches instantly to another. This significantly reduces the likelihood of failed transactions and prevents churn.

Orchestration also adds flexibility. SaaS platforms can offer more local methods for customers to choose from. With careful orchestration, a business’s focus on convenience translates into a smoother, more seamless checkout experience for customers.

High-risk industries

Risk-prone industries, such as travel, iGaming, cryptocurrency, pharmaceuticals, etc., frequently face higher fraud rates, increased chargebacks, and higher processing costs. Without centralized management, security, and intelligent routing, each instance of a stolen card and a refund request undermines profitability and reputation.

Payment orchestration provides a robust software solution. It features advanced fraud prevention capabilities, seamless integration with third-party scoring tools. This flexibility allows businesses to tailor the system to meet specific industry objectives.

Payment service providers

PSPs primarily cater to merchants with complex needs that extend beyond having a single basic payment processor. By using orchestration, providers can offer merchants one simple integration. They no longer need to connect to multiple PSPs for different payment methods. Instead, they get everything in one place, which saves time and reduces technical effort. Furthermore, customization offers many opportunities to make software branded.

Orchestration enables PSPs to provide smart features without having to build them from scratch. This makes them stronger competitors and more valuable partners for merchants.

Payment Orchestration Features That Unlock New Opportunities

Orchestration stands at the forefront of financial technology thanks to the built-in tools. The key payment orchestration features work together to create a more resilient and efficient payment ecosystem:

- Routing. The intelligent process determines the logic of the transaction pathway from a customer to a recipient across various financial networks.

- Cascading. This mechanism acts as a backup for failed transactions. It immediately reroutes them to a secondary or tertiary processor to ensure their successful completion.

- Analytics. Real-time data collection and the use of machine learning help optimize payment flows, boost success rates, cut costs, prevent fraud, and reveal customer insights.

- Integrations. These are the connections between payment gateways, processors, acquirers, and other providers in an ecosystem.

- Security and risk mitigation. This involves tools for fraud prevention, data protection through tokenization, encryption, and authentication. PCI DSS and GDPR certifications ensure compliance.

Benefits of Payment Orchestration for Modern Businesses

To overcome challenges associated with online transactions and complex integrations, many companies turn to payment orchestration as a smarter way to manage their payment flows.

There are multiple payment orchestration benefits that can improve business operations and drive growth.

Multi-acquirer approach

It means merchants can easily and quickly obtain the necessary integrations. This can be achieved with a single integration to the platform via an open API, rather than integrating them individually, thanks to a comprehensive payment orchestration infrastructure.

Greater payment system reliability

Relying on various banks and payment providers instead of a single one or a few ensures the payment system’s resilience. If one acquirer experiences issues, transactions can be processed through alternative providers, eliminating disruptions. Due to this, merchants avoid losing customers whose payments failed to go through.

Increased approval rate

At the core of payments orchestration lies intelligent routing and cascading. The routing mechanism sends transactions to payment providers most likely to approve them. When one payment provider declines a payment, cascading technology redirects it to the other for successful completion.

Together, these technologies can boost transaction approvals by up to 30%. By using smart routing payment gateway technology, businesses can ensure more efficient payment processing and minimize the risk of failed transactions.

Optimized processing costs

The payments orchestration layer helps businesses cut processing costs. It can route transactions to payment providers with the most competitive interchange fees.

To establish an optimal transaction processing strategy for your business, you can define routing rules for different transaction types (i.e., local and international payments). In this way, you will ensure each of them is sent to providers with the lowest processing fees. As a result, you can cut your processing costs up to 25%.

Enhanced payment security

To provide payment services, a company must comply with the latest security standards. This requirement prevents malicious companies from entering the market.

Additionally, payment orchestration features multiple security measures to ensure transaction integrity. They include anti-fraud filters, tokenization, and encryption. They also partner with third-party risk-scoring providers to prevent unauthorized access or fraud.

Improved customer satisfaction

Payment orchestration provides built-in analytics, enabling you to gain insights into customers’ payment preferences, identify the top reasons for declined payments, and view the most frequently used providers and payment methods. In addition, it can help address any shortcomings in their existing payment processes.

How Can Akurateco Help Your Business Enhance and Grow?

Akurateco integrates the key payment orchestration features into a white-label payment orchestration platform to help businesses simplify management and scale globally:

- Over 600+ integrated banks and payment providers that support a wide range of traditional and alternative payment methods.

- Custom integration is available upon request.

- Improved approval rates by up to 30% thanks to intelligent routing and cascading.

- Payment Team as a Service model, with constant troubleshooting and support tailored to your business needs.

- PCI DSS Level 1 certification, anti-fraud modules, and partnerships with external risk-scoring providers, including Fraudio, MaxMind, and AcuityTec.

- Data-driven insights with advanced analytics and open API access for custom reporting.

FAQ

How big is the payment orchestration market?

According to data from Custom Market Insights, the payment orchestration market size reached USD 1.8 billion in 2025. In fact, the scope of who uses payment orchestration is increasing every year. By 2034, it is projected to grow to USD 13.4 billion.

Why do we need payment orchestration?

Payment orchestration is crucial if your business aims to optimize payment operations or expand to multiple locations. With orchestration, you can efficiently manage your payment ecosystem and scale your business effectively in an ever-evolving digital landscape.

What are the key benefits of implementing payment orchestration for businesses?

There are several payment orchestration benefits your business can experience right away. Using this technology can enhance your transaction approval rate, increase your conversion ratio, and broaden the range of banks and payment methods available. It also enables savings on processing costs, improves customer satisfaction levels, and facilitates business expansion into new regions.

What are the technologies that payment orchestrators provide?

Payment orchestration comes with a set of robust, built-in tools that enable this software to function effectively. Key payment orchestration features include seamless integrations, intelligent routing and cascading, security and risk mitigation, and actionable analytics. They help businesses enhance their payment processes, optimize costs, reduce fraud, and better cater to their customers.