Many payment service providers (PSPs) rely on in-house software that generally meets their requirements but falls short of modern technologies and integrations. This software, tailored specifically to their needs, has proven itself through time, making PSPs reluctant to replace it, yet impossible to upgrade in terms of infrastructure.

Fortunately, there is a viable solution to address this challenge that doesn’t require switching to another system – a payment gateway extension for payment service providers. It seamlessly integrates with the current software in order for PSPs to maintain their core functionality while using the extension’s advanced technologies and integrations.

Akurateco is a white label payment gateway created by experts with 15+ years of hands-on experience in online payments that took into account all the problems faced by merchants and payment service providers in developing the performing intelligent payment routing technology. In this article, Akurateco’s Founder and CTO, Andrew Riabchuk, explains the payment gateway extension meaning, examines the main challenges it addresses, and describes how to integrate a payment gateway extension into the current software in a seamless and efficient way.

What is a payment gateway extension?

Payment gateway extension refers to the seamless integration of a current payment software provider’s system with an external payment gateway via an open Application Programming Interface (API). By providing access to advanced technologies and multiple integrated banks and payment providers, a payment gateway extension significantly enhances the functionality of a payment service provider’s current platform. This empowers them to offer a broader array of services, delivering their customers a more versatile and enhanced payment experience.

7 main issues that a payment gateway extension addresses

Here are several challenges that a payment gateway extension efficiently addresses, along with payment gateway extension integration challenges that PSPs must be aware of when considering this solution.

Lack of integrated payment methods

Payment software providers can eliminate the lack of payment methods integrated into their own systems by employing a payment gateway extension. One of the core benefits of payment gateway extension is the ability to support multiple payment methods out of the box. If the provider lacks the necessary expertise, time, resources, or a dedicated team to develop new integrations, they can seamlessly incorporate a diverse range of payment options with a ready-to-use payment gateway extension. The extension already has multiple banks and payment providers integrated via open API. By leveraging them, the software provider can swiftly adapt to evolving market demands, offer a more comprehensive and customized payment experience, and stay ahead of the competition development-free. If you’re exploring how to make a payment gateway for your business, this solution can provide the necessary tools and scalability without building everything from scratch.

Insufficient functionality

A white-label payment gateway extension is particularly advantageous for companies operating with software that relies on long-standing legacy code, hindering their ability to adopt modern payment technologies. Such PSPs are faced with three options:

- Develop a new system with cutting-edge technologies from scratch.

- Switch to a white-label payment gateway.

- Integrate a payment gateway extension and leverage advanced functionality with its current system.

Payment gateway extension will also benefit local and global payment service providers that operate within specific geolocations and cater to particular business verticals. However, when they seek to expand into new markets or venture into different business verticals, they often encounter a significant challenge – their existing functionality may not meet the needs of new markets.

For example, let’s consider a payment service provider whose system currently processes only traditional card transactions. As the PSP wants to expand its offerings to cater to the growing demand for alternative payment methods like crypto payments, they need to develop new functionality to support this payment flow, investing lots of time, effort, and resources into it. Yet, creating the required functionality in-house would not only prove costly for the payment service provider but also consume a substantial amount of valuable time. Alternatively, PSPs can opt for a more efficient approach by leveraging a ready-to-use payment gateway extension offered by another payment software provider via an open API, easily accessing the much-needed functionality and integrations.

Shortage of vital payment expertise

When a payment service provider operates within a specific payment industry, they possess the necessary expertise to offer advanced services to their existing customers. However, if the PSP decides to venture into a new market they are unfamiliar with, they might lack the expertise and knowledge required to operate successfully in that new domain.

In this case, opting for a payment gateway extension can be a strategic move. By adopting it, the PSP gains more than just access to the software itself. They also benefit from the expertise of the vendor’s dedicated payment team.

With the support of the vendor’s skilled professionals, the PSP can swiftly adapt to the unique requirements of the new market, implement the necessary features, and address any regulatory or compliance considerations efficiently. This approach significantly reduces the time-to-market for the PSP, enabling them to establish a strong presence in new regions and effectively cater to the payment preferences there.

Limited control over payment flow

Numerous payment software providers hesitate to collaborate with third-party software because they fear losing the ability to independently monitor transaction flow and manage merchants, integrated banks, and payment providers. Yet, implementing a payment gateway extension does not eliminate this possibility. The extension’s integration empowers the PSP to establish a connection to an external payment gateway that processes transactions. What sets this solution apart is that these transactions also go through the PSP’s system or are being duplicated within it, allowing it to maintain full control over the transaction flow.

Poor system infrastructure

Many payment service providers currently operate on legacy software developed a decade or more ago when microservice architecture, process virtualization, and orchestration systems were not yet used. While these providers recognize the benefits of embedding modern payment technologies into their software, their implementation would require a complete system rewrite.

The integration of a white label payment gateway solution solves this problem. By integrating the extension, PSPs access a cutting-edge system that boasts remarkable dynamism and scalability, aligned with modern business development requirements.

To illustrate this with an example, let’s consider a payment service provider that currently processes 100K transactions using its legacy software. As the PSP aspires to expand its operations and handle 1M transactions, it faces a significant challenge – its existing infrastructure cannot accommodate such a high volume.

In this scenario, the PSP can leverage a payment gateway extension advantages like scalability and reduced development costs as an efficient solution. By integrating the extension into their system, they can offload the main part of the transaction load to this new system. Its cutting-edge architecture allows it to efficiently handle a larger volume of transactions, enabling the PSP to smoothly scale its operations without extensive infrastructure improvements or costly upgrades.

PCI DSS Certification

Compliance with Payment Card Industry Data Security Standards (PCI DSS) is essential for payment gateways to handle card data securely. Additionally, PCI DSS imposes certain restrictions on the type of integration merchants can have with payment gateways.

Some merchants specifically seek Server-to-Server (S2S) integration, which requires them to comply with PCI DSS. However, not all payment service providers (PSPs) are equipped to assist their merchants in achieving PCI DSS compliance and may not offer S2S integration as an option.

In such cases, PSPs can explore an alternative solution – a payment gateway extension. By integrating the extension into their system, PSPs can offer S2S integration for merchants seeking that specific type of integration. Plus, the vendor’s payment team can assist merchants in achieving PCI DSS compliance to handle card data securely and ensure their system adheres to the required standards.

Threats to transaction security

As infrastructure complexity reaches new heights, PSPs face numerous security challenges.. However, by adopting a payment gateway extension, a significant liability shift occurs in favor of the PSP. This shift happens because transactions now pass through not only the PSP’s system but also through the payment gateway extension, which comes equipped with its robust anti-fraud mechanisms and third-party risk-scoring providers. These additional layers of security verify transactions for potential threats, significantly reducing risks to the PSP’s business.

In light of the benefits that the payment gateway extension brings to payment service providers, let’s delve into the process of its integration by the PSP and its merchants.

Payment gateway extension integration

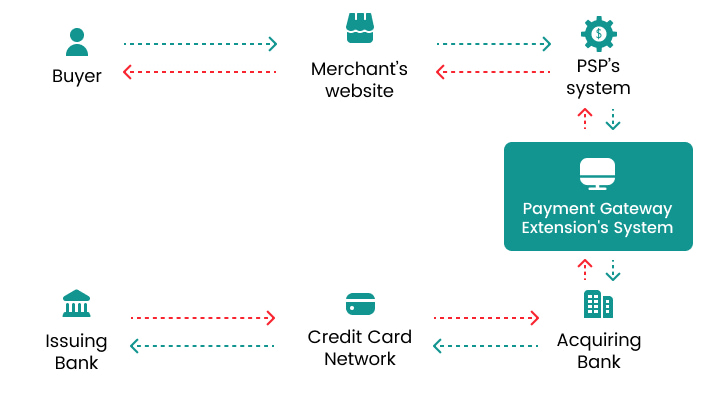

Payment service providers connect to the payment gateway extension using an open API, enabling transaction transmission to the extension, which forwards them to the payment partners handling processing transactions.

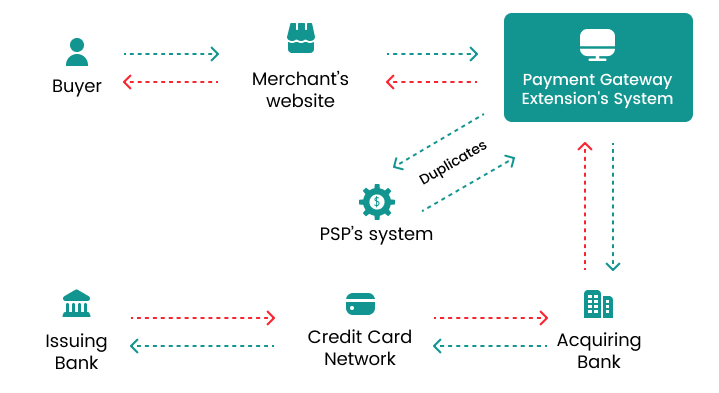

Additionally, the payment gateway extension can replicate the existing PSP’s partner structure, encompassing a variety of payment providers, merchants, and their respective hierarchies. Duplication allows the extension to mirror the current hierarchy, ensuring a smooth transition to the new system.

Regarding merchant integration, the payment gateway extension offers two distinct options:

Merchant’s integration via PSP’s current system

In the case of merchant integration via PSP’s current system, transactions flow through the PSP system and are then forwarded to the payment gateway extension for processing. Using this integration method, merchants continue to leverage their existing PSP system. The users retain their current dashboards, personal accounts, and system interfaces while accessing new integrations, payment flows, enhanced features, and capabilities offered by the payment gateway extension.

Merchant’s direct integration with the payment gateway extension system

When a merchant integrates with the payment gateway extension system directly, transactions flow through the extension’s system firsthand. Still, they are duplicated in the PSP system for monitoring and control. This approach empowers merchants to directly leverage the payment gateway extension’s functionalities while allowing the PSP to retain oversight over the payment flow.

Over to you

Integrating a payment gateway extension can be highly beneficial to payment service providers. Yet, the most efficient result can be achieved only when partnering with a robust payment gateway extension provider.

We at Akurateco offer a payment gateway extension equipped with the latest technologies and 270+ integrated banks and payment providers for PSPs of all kinds. Don’t hesitate to contact us for a Free system Demo and personalized consultation with our experts — we’ll show you exactly how to integrate payment gateway extension functionality into your existing infrastructure.