- What Is a Payment Gateway, and How Does It Work?

- Why Businesses Build Their Own Payment Gateway

- Custom Payment Gateway Development: Pros

- Custom Payment System Development: Cons

- How to Build a Payment Gateway from Scratch: Step-by-Step

- Key Factors to Consider When Developing a Payment Gateway

- Other Factors to Consider

- Cost of Payment Gateway Development

- Custom vs. White-Label Payment Gateway: Which Option Is Better?

- How Akurateco Helps You Launch Your Own Payment Gateway Faster

- Real Results: How Businesses Succeed With Akurateco

- Conclusion

- FAQ

With the digital payments market projected to reach $361.3 billion by 2030, businesses that fail to modernize risk falling behind. The core of the payment stack is usually where most forward-thinking companies start. Therefore, more and more PSPs, fintech startups, software companies, and acquirers are exploring how to build a payment gateway to regain control over their payment flows.

Owning your own payment gateway offers better visibility into transactions, optimized routing, and new revenue opportunities. But most companies can’t afford the cost and complexity. Building a payment gateway from scratch is expensive and time-consuming. It requires strong technical skills, knowledge of compliance rules, and a dedicated team. Many choose to take a shortcut by turning to established providers, such as Akurateco, who help them deploy white-label gateways tailored to their specific needs.

In this article, we’ll explain what a payment gateway is and show you a step-by-step process for creating one. Finally, you’ll be able to decide with confidence whether you should build a payment gateway from scratch or seek white-label options.

What Is a Payment Gateway, and How Does It Work?

A payment gateway is the backbone of online payments. This technology allows businesses to accept transactions securely. It connects a customer’s payment method, such as a card or a digital wallet, to the merchant’s acquiring bank or processor. Its primary mission is to verify, encrypt, and transmit sensitive payment data to ensure every transaction is completed safely.

In the world of online transactions, it’s easy to confuse terms like payment gateway, payment processor, PSP, and merchant account. While they’re all essential parts of the payment infrastructure, each serves a distinct purpose. The table below provides a quick overview to help you better understand how these components interact and what role each plays in the payment flow.

| Component | Main Function | Provides | Key Role |

| Payment Gateway | Collects payment data from the customer and passes it on | Data encryption, transmission, transaction approval/rejection | Bridge between the website, customer, and processor |

| Merchant Account | Specialized bank account for accepting non-cash payments | Fund reception, handling of chargebacks and refunds | Virtual wallet for the merchant |

| Payment Service Provider (PSP) | Offers a suite of fintech tools, including a payment gateway | Payment gateway, analytics, risk management, multi-method payment support | All-in-one payment solution provider |

| Payment Processor | Transfers transaction data between banks and payment systems | Communication between issuing and acquiring banks | Executes the financial part of the transaction |

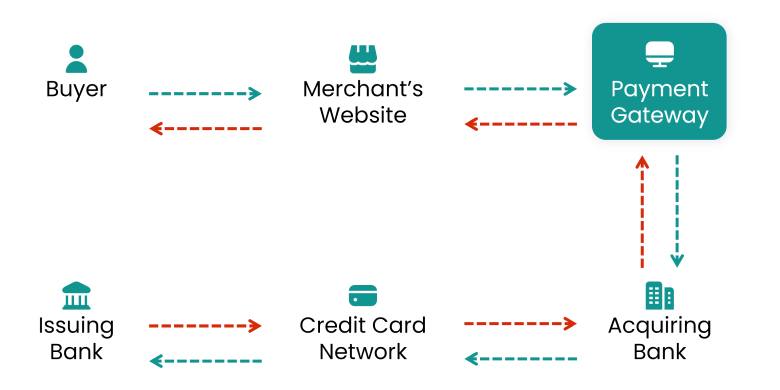

To show you how payment gateway works, let’s look at a typical transaction flow:

- The customer initiates payment on the merchant’s website.

- The payment gateway captures and encrypts the payment information.

- The payment processor connects to the card network for authorization.

- The issuer bank (the customer’s bank) approves or declines the transaction.

- The gateway returns the previous response to the merchant and, in real time, confirms the result to the customer.

In simple terms, a payment gateway acts as a secure line of communication between all parties in a transaction (the customer, merchant, and bank), ensuring that every payment is processed safely and without delay.

The choice of a payment gateway can make or break your results, affecting conversion rates, customer trust, and operational efficiency. Technically, you can create a payment gateway in-house, but that route often proves costly. Many teams realize it too late, after already wasting time on an inefficient, non-scalable, poorly optimized service that drained their resources.

Many PSPs and merchants are shifting toward white-label gateway solutions from established providers like Akurateco. These platforms provide a proven technical foundation you can brand as your own with easy merchant onboarding, diverse connectors, seamless integrations, fraud prevention tools, PCI compliance, optimization, and a unified dashboard with real-time reporting for all your transactions.

Why Businesses Build Their Own Payment Gateway

While renting is more convenient, many companies prefer to create their own payment gateway for a reason. They choose this route primarily for a fully tailored payment experience. This is a significant advantage for large businesses with unique requirements that off-the-shelf gateway solutions can’t satisfy. Among such requirements are recurring bills, support of a number of payment methods, on-demand scalability, and others. That’s why, for many, building a payment gateway in-house seems a reasonable option, offering several substantial benefits:

Control over transaction fees

With a custom gateway, you can bypass preset provider charges, select the most cost-effective acquirers, and directly influence your processing margins.

Customization

Your own payment gateway can be designed around your exact business model, industry, and customer expectations, not the other way around.

Data ownership

Operating an in-house payment gateway gives you full control over the payment data you collect, enabling you to make better decisions using analytics and reporting.

Despite the significant benefits, designing your own payment gateway requires long-term commitment, both financially, technically, and in terms of time.

Development cost

In-house development means allocating substantial financial resources for ongoing development, testing, and addressing unexpected issues. You’ll also need a skilled technical team with industry expertise and the ability to manage integrations, API documentation, and upgrades. Few businesses can really afford this commitment.

PCI compliance

As the owner of a payment gateway, you are responsible for ensuring it is secure and compliant with market requirements. PCI compliance is a critical prerequisite for payment organizations. Failing to abide by this regulation always results in suspension or even a ban by the authorities. If your team lacks compliance expertise, you’ll need additional training or external support, which increases overall project costs.

Fraud prevention

Running your own gateway also means you take responsibility for fraud management. You’ll need to deploy fraud prevention tools, monitoring dashboards, and risk-scoring models. This software is often built in partnership with other third-party vendors. It’s a demanding and costly task because fraud patterns evolve almost daily.

Maintenance

Building doesn’t end once your gateway goes live. It’s actually when the real work begins. A customer support team, investing in monitoring and troubleshooting, keeping software up to date, adapting it to regulations, adding new features, and strengthening security to meet the standards — these are the commitments you sign yourself up for.

Owning a payment gateway is empowering, but it’s equally demanding. Before you dive in, make sure you have a clear roadmap for how to make a payment gateway the right way. It’ll help you plan your steps and allocate resources wisely.

Custom Payment Gateway Development: Pros

As the digital payments industry is currently at its peak, there are multiple advantages to developing a payment gateway. They include:

Cost-efficiency in the long run

The upfront expenses for software development may indeed hit your pocket. Yet, they can shield you from ongoing fees associated with using a third-party system over time. But you will still need to maintain and update the system yourself.

Features tailored to your needs

As there’s no “one size fits all” third-party payment processing solution, you may have to compromise in terms of features and integration. With your own payment gateway system, you can develop specific features and integrations of your choice if you have enough expertise.

Complete control over user experience

The owners of payment processing software fully control transaction data and the user interface. Its analysis empowers you to identify shortcomings that hinder your users from a smooth and user-friendly purchasing experience, enabling you to address them.

Edge in the market

By developing a payment gateway infrastructure, you can fine-tune it according to your specific requirements. Plus, you can craft a unique offering in the competitive fintech market.

One of the key challenges when creating your payment system is protection against fraud. This is why the use of AI and machine learning is becoming a necessity. These technologies allow you to analyze real-time transactions, identify suspicious operations, and minimize financial losses for the merchant and its clients. Without such solutions, your own payment gateway risks becoming a vulnerable link.

However, one of the top reasons businesses explore how to make a payment gateway is to gain better control over security and customization while avoiding recurring fees from third-party systems.

Custom Payment System Development: Cons

While developing your payment system is expensive, technically complex, and poses security risks, these challenges can be overcome. Our white label payment gateway solution offers ready-made modules for accelerated launch, compliance expertise, and integration of AI solutions for fraud protection — to minimize costs, reduce development time, and ensure payment security at the level of international standards.

Here are some potential drawbacks:

Development cost

Payment gateway architecture development can cost you an arm and a leg. It involves significant expenses such as salaries for the development team and specialists, infrastructure costs, security certification fees, and more.

Ultimately, payment gateway cost to build may exceed $500,000, depending on your specific requirements. The payment gateway development cost may exceed $500,000, depending on your specific requirements. Therefore, independent development is not feasible for businesses operating on tight budgets.

Maintenance cost

Since payment gateway maintenance is not a one-time thing but a continuous undertaking, staying abreast of security regulations, integrating new payment methods, and conducting routine software maintenance will become one of your top priorities in the highly competitive e-payments market.

Therefore, when estimating the expenses of internally developed software, it’s essential to consider maintenance costs, which are usually approximately 20 percent of the initial development cost yearly. Also, one often overlooked challenge in making a payment gateway is the long-term cost of keeping it secure, stable, and compliant with evolving standards.

Time-consuming development

Opting to develop software from the ground up requires a long-term commitment. Beyond investing time in the development process, you must also dedicate efforts to finding seasoned specialists with extensive expertise in software development, security protocols, and compliance with financial regulations. Therefore, building a payment gateway is a time-consuming process, potentially delaying your revenue-generating capabilities.

PCI DSS certification

Payment gateways must acquire essential security certifications to guarantee the protection of customers’ credit card data. The Payment Card Industry Data Security Standards (PCI DSS) is a mandatory certification. As the owner of a payment gateway, it is mandatory to certify your software in alignment with PCI DSS standards and undergo the renewal process annually, which is quite costly and complicated.

How to Build a Payment Gateway from Scratch: Step-by-Step

If, after evaluating all the pros and cons, you want to give payment gateway software development a go, here is a general step-by-step guide to help you understand the steps involved:

1. Understand the business model of a payment gateway

Before you jump into action, gain a thorough understanding of how best white label payment gateway generate revenue. This knowledge will help you set clear short- and long-term goals. For more information, check out our in-depth guide covering a payment gateway business model for 2025.

2. Establish objectives and requirements

Software development requires establishing goals and prerequisites for your system. Define its capacity, technologies, integrated banks, payment providers, and other critical details shaping the development process.

3. Recruit a skilled development team

The key to software success is your team. Assemble a team of professionals with software development, security, and compliance expertise, including developers, security specialists, and compliance experts.

4. Choose technology stack

Select the appropriate technology stack for your payment gateway. Consider programming languages, frameworks, infrastructure, and tools that align with your development goals and your team’s expertise.

5. Design architecture

Create a robust and scalable architecture for your gateway based on the expected payment transaction load. Define how different components will interact, ensuring efficient and secure data flow.

6. Implement core features

Develop the core features of your payment gateway, including payment processing, transaction authorization, error handling, and support for various payment methods such as credit cards, digital wallets, and bank transfers.

7. Ensure system security

Implement robust fraud prevention technologies and intelligent routing payments to protect your customers’ sensitive transaction details. Keep payment information secure by encrypting communication channels and securing databases.

8. Integrate with payment processors

Integrate your payment gateway with the Application Programming Interfaces (APIs) of payment processors and acquirers to facilitate transaction authorization and settlement.

9. Perform a system test

Test your system to identify and fix any bugs, security vulnerabilities, or performance issues by running unit, integration, and security testing.

10. Obtain the necessary certifications and licenses

Get the necessary licenses and certifications, such as PCI DSS compliance, to handle payment data legally and securely, minimizing fraud and data breach risks.

11. Go into the live mode

When the system is complete, deploy your payment gateway in a production environment and monitor its performance. Implement real-time monitoring, logging, and error tracking tools to identify and resolve issues promptly.

12. Conduct ongoing maintenance

Establish a plan for ongoing maintenance, updates, and support. Regularly update your payment gateway to eliminate security risks, comply with updated regulations, and improve functionality.

To successfully create your own payment gateway, you must pass through the necessary development stages, including robust architecture development, obtaining security certifications (such as PCI DSS), and integrating securely with acquiring banks and financial institutions.

Equally important is staying current with evolving payment guidelines and compliance requirements, such as PSD2 in the EU or AML/KYC worldwide. Failure to do this can lead to costly litigation, reputational damage, or even shutdowns. Compliance is not a one-time effort but a strategic necessity for long-term existence and confidence in the financial system.

These steps are essential not only for those planning to build internal infrastructure but also for entrepreneurs researching how to create a payment portal that aligns with modern compliance and security standards.

Key Factors to Consider When Developing a Payment Gateway

Essentials of building a payment gateway are covered. Now, let’s explore critical features that make your software fully functional.

Security and PCI DSS compliance

A secure payment gateway starts with strict adherence to PCI DSS standards and extends to measures like KYC, tokenization, and encryption. Doing so not only keeps transactions safe but also saves your company from penalties and reputational risk.

Scalability and uptime

At a specific period of time, your business will have more users, more transactions, and heavier workloads. Your gateway must be capable of handling such operations from the start, ensuring uninterrupted performance. That means scalability and uptime should be among your top priorities when developing a payment gateway. They ensure that traffic spikes or system slowdowns never disrupt payment processing or impact customer experience.

Fraud and chargeback management

To protect both you and your customers, your payment gateway must integrate automated fraud prevention and chargeback management. Anti-fraud tools anticipate and prevent suspicious activity before it escalates. Plus, they help reduce the likelihood of future fraudulent transactions. Chargeback modules keep dispute handling organized and far less painful.

UX/UI and checkout optimization

Every customer expects payments to be simple, seamless, and fast. Your design should reflect that. Make the checkout as simple as possible, provide short instructions to guide users, and display only essential fields. This will help increase your conversions and build trust.

Multi-currency and local payment method support

To facilitate future growth, your payment gateway should gain customer appeal worldwide. Integrate different popular international and local payment methods while ensuring multi-currency support. Your customers will appreciate this flexibility, enabling them to make payments with their preferred methods and currencies seamlessly.

Other Factors to Consider

Nevertheless, to build a payment system that will be competitive in the market in today’s day and age, combining issuer and acquirer data is not enough. To succeed, you need to have a whole service that will be useful for end users.

Value-added services

This means one payment page should have a certain number of value-added services that will make your customers’ payment experience much more comfortable. These include mobile wallets, Google Pay, and Apple Pay, as well as the connection to all card schemes such as MasterCard, Visa, and American Express. Also, it should offer a Direct Debit option for users from certain geographical countries.

Streamlined checkout process

Streamlining the checkout process is another crucial strategy to keep in mind. Minimize the number of interactions required to complete a purchase with the help of streamlined security measures like 3D Secure 2.0 and network tokens, as well as by offering alternative payment methods – crypto payments, Buy Now, Pay Later (BNPL), and more.

Microservices

In order to have a seamless experience and keep services up even when some of them might experience downtime, your system needs to be divided into microservices. These include the dashboard, merchant onboarding functionality, merchant management system, reporting, reconsolidation, routing, cascading, etc. Akurateco takes this approach into account, offering you a reliable microservices architecture.

Cost of Payment Gateway Development

The biggest question about in-house payment gateway development is the cost. It’s a serious investment that requires a heavy financial commitment. So, how much does it cost to make a payment gateway?

A simple setup will cost around $500,000, while complex enterprise solutions can reach $1M. Simply put, the total cost depends on the functionality, features, certifications, and additional services you need.

Significant upfront and recurring expenses make businesses explore white-label payment gateway development platforms. If you compare associated costs between in-house and white-label approaches, you can see it’s a reasonable decision.

With a white-label gateway, the core platform is already built and maintained by the provider. You control the branding, choose the integrations and connectors, and turn on only the features your business needs, so you pay for what you actually use, not for building the stack. The provider handles development, fixes, and upkeep on their side. Altogether, it’s several times more affordable than developing a payment gateway entirely on your own. This way, Akurateco’s white-label gateway solution helps businesses reduce costs and guarantee a fast time-to-market.

Custom vs. White-Label Payment Gateway: Which Option Is Better?

If you’re on the fence deciding between a custom or white-label payment gateway, let’s compare both approaches in real examples.

An in-house payment gateway gives you full control over the entire infrastructure, but it also comes at an equal cost. Developing a payment gateway normally means spending months of development, expensive integrations, and ongoing maintenance. In fact, the stages of maintenance and upgrading are where the real challenge begins. Adding a single connector, for example, can take two months. Multiply that by dozens of connectors, and the timeline and costs rise exponentially.

On the other hand, with a white-label payment gateway, you get the same level of control at a lower price, paying only for the infrastructure. No development hassle, maintenance worries, or customer support issues. Time-to-market is much faster compared to custom development. In fact, you can have a fully functional payment gateway within a predictable timeline, unlike the often prolonged and uncertain delivery times of in-house builds. And that’s exactly what Akurateco provides.

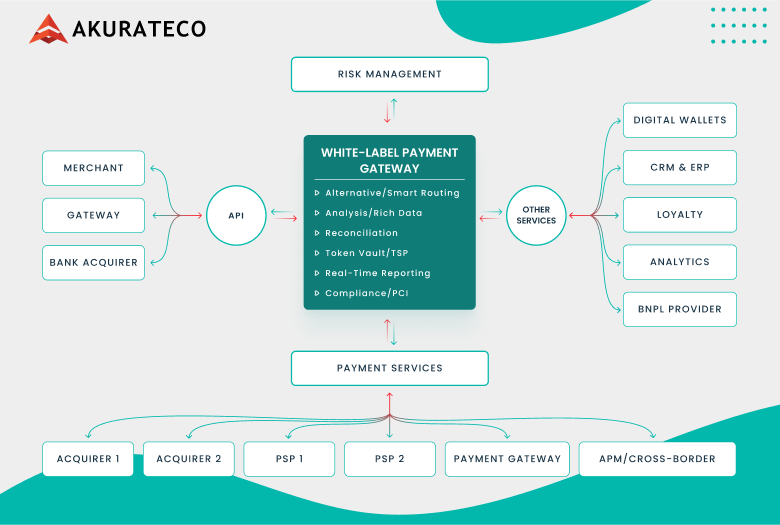

How Akurateco Helps You Launch Your Own Payment Gateway Faster

Akurateco’s white-label payment gateway offers a turnkey solution that enables you to deploy your branded payment system in a matter of weeks without getting bogged down with the heavy lifting of in-house development. With 600+ connectors, pre-integrated global and local payment methods, you can ensure seamless, future-proof scalability into any market you intend to enter.

Akurateco enables you to onboard once. We take care of maintenance, troubleshooting, customer support, and other technical work. As a result, you benefit from substantially reduced costs that you would splash out on in-house development.

You don’t just get access to payment methods. You get access to a whole payment ecosystem, including:

- Smart routing for peak approval rates.

- Cascading to minimize declined payments.

- Recurring billing for subscription-based models.

- Automated merchant onboarding to accelerate growth.

- AI-driven analytics, real-time reporting, and fraud prevention tools.

- PCI DSS Level 1 compliance and chargeback management.

Your entire platform is branded with your own identity. Your business belongs to you, and we provide you with the engine to drive it.

Real Results: How Businesses Succeed With Akurateco

Businesses exploring how to become a payment gateway quickly discover that building from scratch is rarely the most effective route. With a white-label platform like Akurateco’s, they can achieve the same level of autonomy but at a significantly reduced price and much faster.

Our technology speaks for itself, as do our clients’ results. Below are real-world examples of how companies from various industries scaled faster, optimized payments, and entered new markets with Akurateco’s ready-made gateway infrastructure.

Dineropay

Dineropay needed to launch a mobile payments platform that could meet Saudi Arabia’s strict financial regulations and handle increasing transaction volumes. Developing their own infrastructure from scratch would have taken years, time they couldn’t afford in a rapidly evolving market.

By partnering with Akurateco, Dineropay implemented a white-label payment gateway equipped with automated merchant onboarding, real-time analytics, and advanced fraud prevention tools. The solution provided a seamless integration framework and localized payment support essential for the MENA region.

If you’re interested in exploring the Dineropay case in detail, read more about this success story on our blog.

TESS

TESS, a fintech operating in Qatar’s tightly regulated financial landscape, sought to expand its service offering while maintaining compliance with local and international payment standards. Their in-house infrastructure couldn’t scale efficiently or meet the country’s data security requirements.

Through Akurateco’s white-label payment gateway, TESS gained access to a PCI DSS Level 1–certified platform with built-in fraud management, chargeback handling, and API-driven integrations. The platform’s modular structure allowed them to tailor features for different merchant segments and ensure smooth expansion.

If you’re interested in exploring the TESS case in detail, read more about this success story on our blog.

Conclusion

Many businesses that want more flexibility and control over their payment infrastructure start by looking into how to create a payment gateway. But in practice, this route rarely fits their timelines, budgets, or growth goals. White-label platforms like Akurateco offer a smarter alternative, providing faster setup, seamless integration, and a smooth launch, all without compromising scalability or compliance.

Partnering with the right technology provider defines your business’ present and future. Akurateco delivers the expertise, technology, and infrastructure to power your growth and market expansion.

FAQ

Can I build my own payment gateway?

Yes, but it’s complex. Custom payment gateway development requires extensive knowledge of payment processing, security standards (like PCI DSS), encryption, and compliance regulations. You’ll need to integrate with various financial institutions, manage transaction routing, and ensure your system is secure and scalable.

How to set up a payment gateway?

If you’re looking into setting up a payment gateway, you’ll need to follow steps such as defining business requirements, developing core functionalities, ensuring security compliance, and integrating with financial institutions.

Is it hard to integrate a payment gateway?

Integrating a payment gateway can be straightforward with the right API documentation and pre-built libraries, but it can get more complex depending on your system and needs. If you require advanced features or need to comply with PCI DSS standards, the process may take more time and expertise.

What do I need to start a payment gateway company?

You’ll need a licensed business entity, PCI DSS certification, and a secure payment infrastructure. Integrations with acquiring banks, processors, and payment methods, as well as fraud prevention and merchant management tools, are also critical.

How much does it cost to get a payment gateway?

The cost of a payment gateway varies based on the provider, features, and transaction volume. An average price for a basic setup is around $500,000. An advanced system with additional features and custom configurations will cost you over $1 million.

How do payment gateways make money?

Payment gateways make money primarily by charging transaction fees. These fees typically consist of a percentage of each transaction (usually 2-3%) plus a fixed fee (such as $0.30 per transaction).

What is the difference between a payment processor and a payment gateway?

A payment gateway securely captures and transmits payment information from the customer to the payment processor. A payment processor handles the transaction after it’s sent by the gateway, working with banks and card networks to authorize and settle the payment.

Can I use a white-label payment gateway instead of building one?

Yes. White-label payment gateways provide ready-made, fully compliant infrastructure that can be branded as your own. For most businesses exploring how to start a payment gateway company, a white-label solution is a better option, as it provides all the technology, compliance, and support out of the box.