A white label fintech platform is a customizable, ready-made financial technology solution that businesses can brand as their own. It allows companies to offer financial services and products without developing the technology from scratch, saving time and resources.

White label fintech solutions deliver key benefits: faster time to market, cost savings, brand consistency, scalability, and access to cutting-edge financial technology. They enable businesses to provide competitive financial services while maintaining their brand identity.

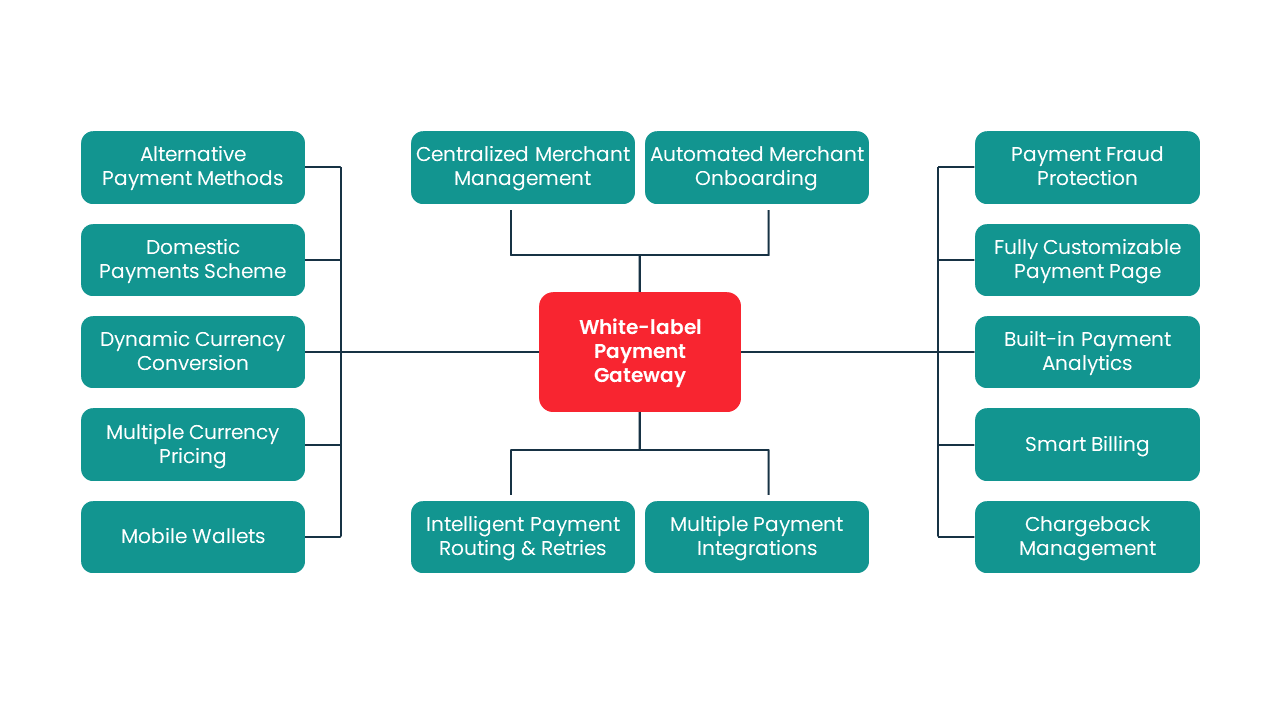

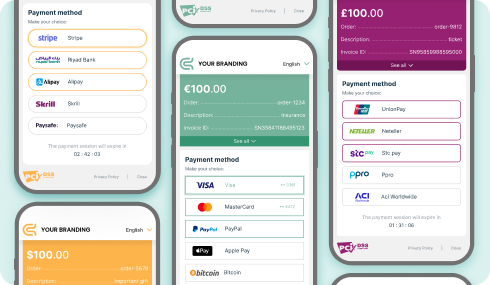

Yes. Akurateco’s white label payment solutions cover digital payment processing, advanced risk management, anti-fraud tools, and regulatory compliance (PCI DSS, GDPR, etc.). This ensures secure and efficient financial operations for your business.

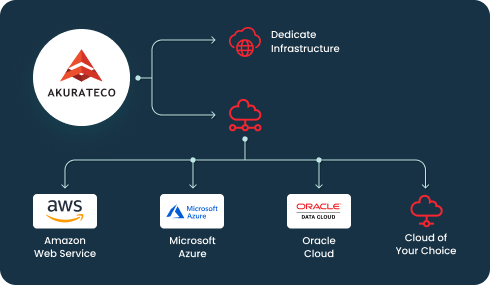

Security is at the core of our white label fintech platform. We implement PCI DSS Level 1 certification, GDPR compliance, and industry-leading fraud prevention tools to protect your business and customers.

Our white label fintech solutions are designed to grow with you. From startups to enterprises, the platform adapts to increased transaction volumes, new geographies, and evolving regulatory requirements.

Any organisation handling payments, including PSPs, acquirers, neobanks, SaaS providers, marketplaces, e-commerce, gaming, travel, and subscription services, can benefit from white label fintech solutions. With our platform, you can quickly launch and scale your business.

It depends on your business needs. Most clients go live in as little as five business days using our ready-to-deploy infrastructure and 600+ pre-integrated payment methods. Our white label fintech platform accelerates time-to-market while ensuring full compliance and reliability.