Payment Orchestration Platform

One Integration = 500+ Payment Connectors

How Payment Orchestration Simplifies Business Operations

To maintain a competitive edge, global merchants, startup and established payment providers, and other financial institutions, require a flexible and efficient payment infrastructure. Payments orchestration platform streamlines operations, optimizes payment flows, and enables seamless access to multiple providers and technologies— all through a single platform.

Launch your payment platform without hiring a development team and cut processing costs with payment routing and cascading.

Get your platform up and running in two weeks with the latest payment technologies and 500+ integrations.

Manage and oversee multiple payment providers from a single, unified platform.

Strengthen your brand with a fully white-labeled solution tailored to your business needs—from payment flows and features to integrations.

Effortlessly expand to new markets and increase transaction volume as your business grows.

Streamline billing, payment analytics, merchant onboarding, and transaction management.

Check out how leading businesses optimize payments with Akurateco

Orchestration Features for Optimized Payment Management

Leverage a powerful multi-provider solution by a global payment orchestration company designed to enhance payment efficiency, security, and flexibility.

Intelligent routing & Cascading

Automatically direct transactions to the best-performing provider based on parameters like cost, region, or card type.

If declined, retry instantly via alternative channels, ensuring successful processing within a single payment attempt.

Network tokenization

Protect sensitive details at the network level, reducing fraud by up to 28% and boosting authorization by 3%.

Enable seamless recurring payments with automatic card updates when cards are reissued.

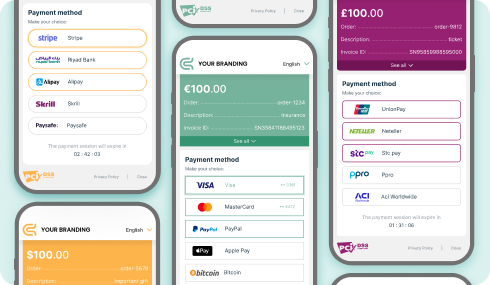

Fully customizable payment page

Dynamically display the most relevant payment options, including mobile wallets, BNPL, and APMs.

Guarantee flawless performance across desktops, tablets, and mobile devices.

Align your checkout with your brand using SDK tools.

Multi-currency & payment method support

Accept payments in local and international currencies using the most relevant methods worldwide.

Expand reach and increase conversions with over 500+ payment providers and banks.

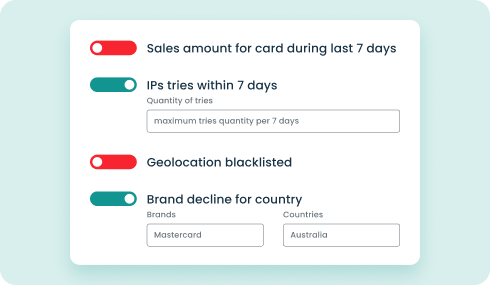

Real-Time Analytics & Fraud Prevention

Monitor transactions with actionable insights and over 150 customizable fraud filters.

Built on 50+ years of combined expertise, our engine adapts to evolving threats in real time.

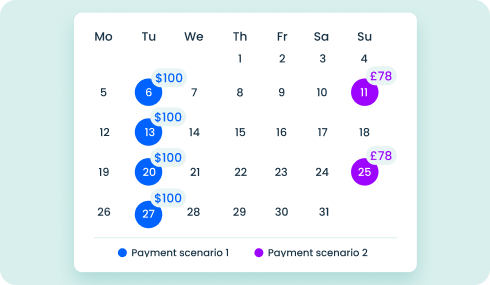

Recurring Payments & Pay by Link

Automate subscriptions with flexible billing options and tokenized Apple & Google Pay support.

Or, collect one-time payments with secure links sent via email, chat, or SMS.

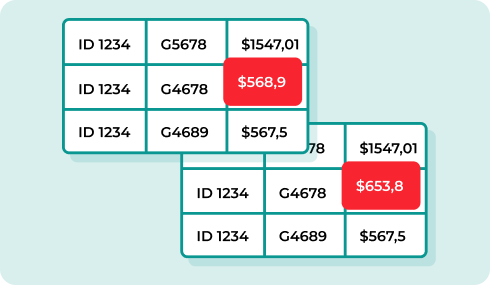

Payment Reconciliation

Match transactions across providers and streamline settlement tracking.

Reduce manual effort, errors, and reconciliation time with powerful built-in tools.

Increase transaction approval rates by up to 20% with payment orchestration

Success Stories from Our Customers

Turn every transaction into a win with payment routing

With Akurateco’s intelligent routing, each payment is automatically sent to the provider that is most likely to approve it.

And if the first attempt fails? Our cascading engine jumps in, instantly rerouting through backup channels to keep the payment—and your revenue—on track.

Maximize Security & Approval Rates with Network Tokenization

Encrypt sensitive card details at the network level with Akurateco’s network tokenization, cutting down fraud and lifting your approval rates.

It also supports automatic card lifecycle management, meaning customers can continue paying even after card updates — no disruptions, no drop-offs.

Ready to elevate your payment strategy with Akurateco?

Who Benefits the Most from Our Payment Orchestration Solutions?

Players from many industries can benefit from payment orchestration services.

New PSPs

Reduce the time and cost of launching a new payment processing business.

Existing PSPs

Integrate an orchestration layer to expand their offering with additional value-added solutions and integrations.

Merchants can maximize revenue and minimize payment friction by using a Multi-PSP strategy.

Connecting multiple providers ensures optimal transaction routing based on approval rates, fees, and market coverage.

Banks and financial institutions can enhance their infrastructure with orchestration-driven innovation, meeting merchants’ growing demand for flexible, feature-rich payment solutions.

Why Choose Akurateco?

Proven performance, measurable results, and unmatched flexibility—everything you need from a payment orchestration provider.

Have we convinced you yet?

Let us showcase how our system can optimize your business.

FAQ

What is a payment orchestration platform?

Payment orchestration is a system created by established professionals. It allows you to centralize and optimize multiple payment methods, gateways, and processors under one roof. This model simplifies the payment process for merchants. It also increases transaction success rates, boosts revenue, and enhances the customer experience. By managing different aspects of payments remotely and automatically, orchestration enhances payment efficiency.

What is the difference between a payment gateway and a payments orchestration platform?

A payment orchestration platform serves a much broader role than a payment gateway. Payment gateway mainly focuses on facilitating transactions between customers and merchants. Payment orchestration is a comprehensive solution. It manages various payment gateways, methods, and providers. It doesn’t just handle transactions. It is engineered to improve the whole payment flow. It brings together the diverse elements of the payment process to ensure efficiency and success.

How can Akurateco’s payments orchestration company improve my business?

Akurateco improves payment operations by offering 500+ payment providers via one integration. Our advanced technologies, like smart routing, cascading, and payment analytics, maximize approval rates. They also help reduce costs and enhance the customer experience. We provide more than consulting support. Our Payment Team as a Service features talented payment experts who can tackle any challenges.

What industries benefit the most from Akurateco?

Our platform serves a variety of industries. They are e-commerce, fintech, marketplaces, travel agencies, gaming firms, subscription services, etc.

Any business that processes a high volume of online payments can leverage Akurateco. With our platform, you can outsource payment management, optimize transactions, and expand globally.

Can I use Akurateco with my existing payment providers?

Yes! You can easily connect Akurateco to your payment provider as a payment gateway extension. This will enable you to enhance your payment strategy while maintaining existing partnerships. Check out our latest article about payment gateway extensions.

Is Akurateco’s platform secure?

Absolutely. Our platform is PCI DSS Level 1 certified. We also offer advanced security features. They include tokenization, real-time AI-driven fraud prevention, and third-party risk-scoring providers. This ensures the highest level of data protection.

How long does integration take?

Integration depends on your setup. With our ready-to-use APIs and SDKs, businesses can go live in as little as a few days. Our dedicated support team ensures a smooth and efficient onboarding process.