Creating PSP

Have merchants ready to be served? See a market that’s calling for a reliable PSP? Partner with us on this journey, equipped with the right software to propel you forward.

Advanced platform with a comprehensive suite of capabilities for efficient payments processing

Reliable infrastructure on several independent data-centers with 99,95% SLA

Experienced team that supports and advises you on the technical aspects of running your business efficiently

Request a Demo

But what are the problems that wannabe PSPs often face in their journey?

Why Choose Us?

Fully brandable and absolutely secure payment software with all needed features and 350 integrations to third-party providers setting us apart from competitors and easing your operational challenges.

A system that is truly white-label

Everything within the payment system can be branded to match your company, from payment page and admin panel URLs to logos, buttons and reports.

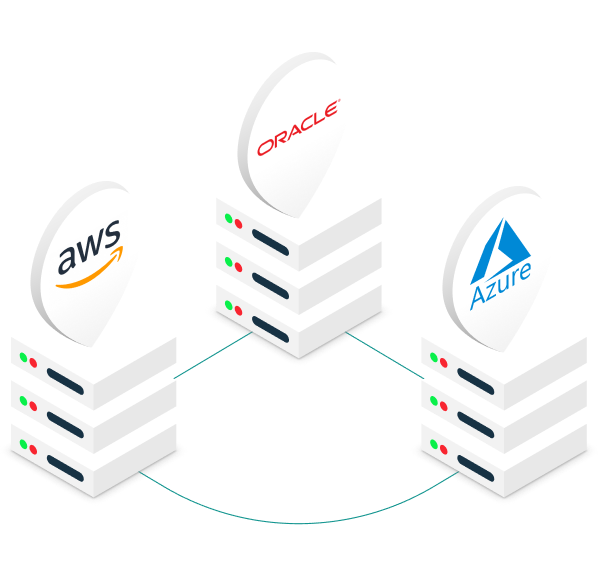

Flexible deployment options

Adapt to your technical and strategic needs with our versatile hosting model. Choose from leading cloud environments, including Azure, Oracle Cloud, and AWS, to ensure optimal performance, reliability, and alignment with your infrastructure preferences.

Payment team as a service